Retiring with a Pension

How does retiring with a pension affect your retirement plans? There are numerous advantages from a tax perspective, and it can also change how much and when you spend your retirement savings. Follow along as we go through the different ways to maximize the flexibility a pension gives you in retirement.

How much can you spend in retirement with a $1.5M Portfolio?

You are 65 years old, and between you and your spouse, you have $1,500,000 saved up for retirement. How much can you actually spend in retirement? Follow along as we examine Chris and Wendy’s scenario and examine their expenses pre- and post-retirement.

3 Underused Tax Strategies In Retirement

Here are 3 underused tax strategies in retirement, and they involve charitable donations. Before recommending these charitable donation tax strategies to clients, they need to meet certain thresholds. After these two thresholds are met, then we can dive into the three underused tax strategies when giving to charities. The three strategies are withdrawing funds from […]

Steer Clear of These Two Mistakes in Retirement

Typically I don’t talk about investing in our videos but today I want you to steer clear of these two mistakes in retirement. The two mistakes to avoid are poor portfolio construction not aligning your retirement portfolio with your retirement withdrawal strategy.

Why you shouldn’t hire me for a one-time retirement plan

Why you shouldn’t hire me for a one-time retirement plan? Because things change over time! As soon as one variable in the plan changes, the plan becomes obsolete. Income needs change, tax rules change, and investment returns vary. A retirement withdrawal plan is not something you create once and can follow blindly for the […]

Why Most Retirees Underspend In Retirement

Why Most Retirees Underspend In Retirement? It’s a common issue I see again and again. Turning the switch from accumulating to decumulating in retirement can be hard. Watching your portfolio go down in value is gut-wrenching for some. The fear of running out of money, kids, and grandkids is another common reason why retirees […]

Retiring at 55 with 2 Million

What does retiring at 55 with 2 million look like? How much will you be able to spend on a monthly basis? Find out as we discuss Heather’s situation.

How Often Should You Make RRSP Withdrawals?

How do you efficiently take money out of your RRSP’s tax throughout the year? How do you do this? Do you withdraw monthly, quarterly, or annually? This is a question we receive all the time. Here are the pros and cons of each withdrawal frequency and what we think about when we go through this […]

Tips for Large RRSP Withdrawals

You’ve done a good job saving and have a sizeable nest egg set aside in your RRSPs for retirement, but how do you make tax-efficient RRSP withdrawals? This is the part that most people get wrong and why you hear so many people say they hate RRSPs. Here are tips for withdrawing from a large […]

Why Living Off Your Portfolio’s Interest in Retirement is Dangerous

What if you could live off your portfolio’s interest without spending any of your principal? Wouldn’t that be something to know that your original capital is still there every time you look at your portfolio? With interest rates higher than they’ve been in years, this seems more possible than ever. However, this can be a […]

The Best Age to Convert Your RRSP to a RRIF

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/QpITwdNQui8″ css=”.vc_custom_1704405127648{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1704405920464{padding-top: 20px !important;padding-bottom: 20px !important;}”]What’s the best age to convert your RRSP to a RRIF? There are a lot of factors that go into making this decision, such as your age, your current and future income needs, and what other retirement accounts you […]

4 Ways to Calculate What You Can Spend in Retirement

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/lL9AMYslC74″ css=”.vc_custom_1700154773577{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1700155259279{padding-top: 20px !important;padding-bottom: 20px !important;}”]Are you wondering how much you can spend in retirement? If so, you’re not alone. In our latest video, we tackle this crucial question and provide 4 ways to calculate what you can spend in retirement. The First […]

Retiring Soon? 3 Things to Consider

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/YZo49qVgnAQ” css=”.vc_custom_1699034094088{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699036365552{padding-top: 20px !important;padding-bottom: 20px !important;}”]Drawing from countless conversations with retirees, if you’re retiring soon, I think you should consider these three core components. Clarity on Your Retirement Goals and Expenses The foundation of a successful retirement lies in having a clear vision […]

Inflation in Retirement

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/J969UP1–fo” css=”.vc_custom_1699033131493{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699033963122{padding-top: 20px !important;padding-bottom: 20px !important;}”]In the realm of retirement planning, a hidden danger lurks, quietly eroding the foundation of your financial security: inflation. Today, we’ll dig into the impact of inflation in retirement and explore how to build a plan that guards against […]

Managing Your Tax Brackets in Retirement

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/hZniNa0reho” css=”.vc_custom_1699031587886{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699032881455{padding-top: 20px !important;padding-bottom: 20px !important;}”]In the quest to effectively draw down your retirement portfolio, there’s one critical mistake you can’t afford to make—not managing your tax brackets in retirement. As we’ve explored in previous discussions, there’s no universal approach to withdrawing from your […]

Tax-Efficient Retirement Withdrawal Strategies

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/CZ9luOOhz1c” css=”.vc_custom_1699022153690{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699024203181{padding-top: 20px !important;padding-bottom: 20px !important;}”]Do you find yourself burdened by high taxes during retirement? Focusing on tax-efficient retirement withdrawal strategies could save you thousands, if not hundreds of thousands of dollars in taxes throughout your retirement. The Retirement Tax Challenge Retirement success […]

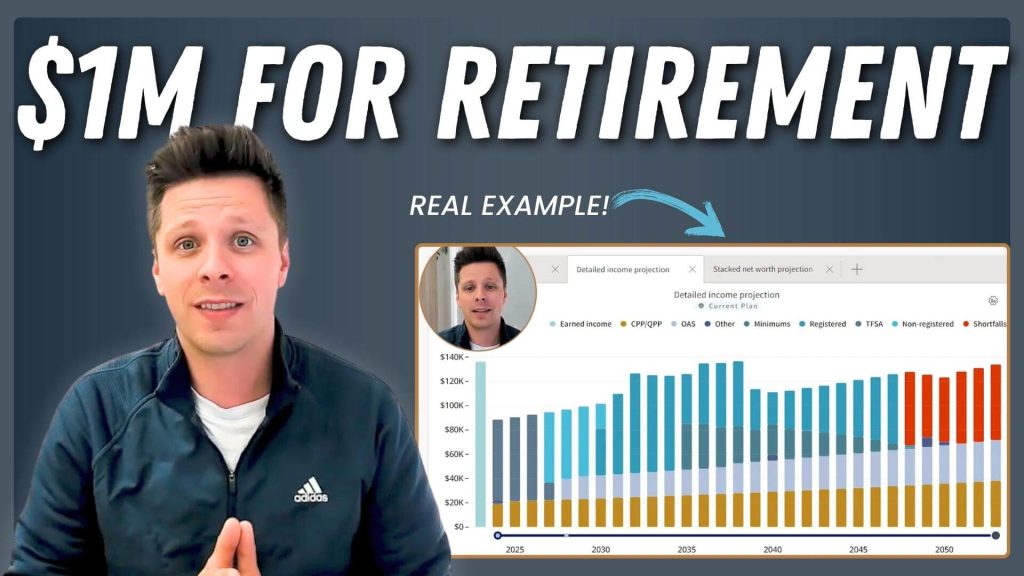

How Much Can You Spend In Retirement?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/xy9fm8LabQU” css=”.vc_custom_1695257135755{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695257153050{padding-top: 20px !important;padding-bottom: 20px !important;}”]You’re 60 and you and your spouse have saved up $1 Million for retirement. How much are you going to be able to spend monthly in retirement? This is the exact question we got asked last week. Today we […]

Which Account Should You Pull From First In Retirement?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/ag2dEb6WGA0″ css=”.vc_custom_1695256591435{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695256602924{padding-top: 20px !important;padding-bottom: 20px !important;}”]Pulling income from the wrong retirement at the wrong time can lead to hefty tax bills. So what account should you pull from first? Let’s dig into it![/vc_column_text][/vc_column][/vc_row]

RRSP Withdrawals Done Wrong!

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/xdazbDGgZlA” css=”.vc_custom_1695256372526{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695256382030{padding-top: 20px !important;padding-bottom: 20px !important;}”]Many Canadians enter retirement without a serious plan to withdraw their RRSP’s tax efficiently, causing them to pay more tax than they need to. Here are a couple of examples of RRSP Withdrawals Done Wrong![/vc_column_text][/vc_column][/vc_row]

Withdraw From RRSP Tax-Free!

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/cq382duYkg4″ css=”.vc_custom_1695255725576{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695255865879{padding-top: 20px !important;padding-bottom: 20px !important;}”]Don’t miss out on this RRSP conversation opportunity. See how Crystal missed out on 3 years of tax-free RRSP withdrawals.[/vc_column_text][/vc_column][/vc_row]

Financially Helping Your Grandchildren

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/-wNLkRw_3o4″ css=”.vc_custom_1690217493745{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Retirement What Ifs

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/SZErI0unZbw” css=”.vc_custom_1690217158884{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Don’t Fall For This Retirement Trap

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/fRDW5cpijCQ” css=”.vc_custom_1690217106020{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Retirement Asset Map

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/PqqI3dDac68″ css=”.vc_custom_1690216250631{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Reduce Retirement Stress

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/6KWuayRuMRw” css=”.vc_custom_1689871994611{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Taking Your CPP Early To Invest

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/ubaxTNXfc70″ css=”.vc_custom_1689869681180{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

What happens to your RRSPs when you retire?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/kMkonk7WhnI” css=”.vc_custom_1689869526639{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

RRSP Withdrawals Due To Shortened Life Expectancy

[vc_row][vc_column][vc_video link=”https://youtu.be/-zDiSZxw-hc” css=”.vc_custom_1689869004749{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row]

Maximizing Your Government Benefits

[vc_row][vc_column][vc_video link=”https://youtu.be/gInDkXCZ8f0″ css=”.vc_custom_1682537628930{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Most Canadians are leaving money on the table when it comes to maximizing their government benefits. In the video above, we review a strategy that individuals and financial advisors often miss. Meet Mike Mike is 65 years old, and his goal in retirement was to be able to […]

Can You Retire On $1 Million

[vc_row][vc_column][vc_video link=”https://youtu.be/aEI85eQWOzY” css=”.vc_custom_1680022632585{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]In our third video in this series, can you retire on $1 million, we look at Richard & Sharon Smith’s financial situation. Let’s see what their financial picture looks like. Let’s start with Sharon. She is currently 60 years old and has the following, RRIF: $400,000 TFSA: $100,000 […]

Drawdown Your RRSPs, 3 Reasons Why You Should

[vc_row][vc_column][vc_video link=”https://youtu.be/NHxPmnG3-dA” css=”.vc_custom_1679067241140{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]RRSPs are a popular retirement savings account, but it may be advisable to draw them down aggressively once retired. Here are 3 reasons to aggressively drawdown your RRSPs. RRSP Tax Bomb There are many people out there who hate RRSPs. I often hear stories like, “My parents had […]

Dividends Don’t Add Value

[vc_row][vc_column][vc_video link=”https://youtu.be/HKo6FKD4qz0″ css=”.vc_custom_1677120607021{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Many investors and financial advisors are fond of dividends and base their entire investment strategy on companies that pay dividends. However, it’s time to take a closer look at the reality of dividends and their impact on investment performance. The truth is, and I might be upsetting the dividend-loving […]

Do You Need Life Insurance Once You Are Retired?

[vc_row][vc_column][vc_video link=”https://youtu.be/cc9qZaJgMPQ” css=”.vc_custom_1675821548137{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Do you need life insurance once you are retired? Life insurance is an important consideration for many people, but as you reach retirement age, the question of whether or not to continue coverage becomes even more complex. Let’s discuss the pros and cons of having life insurance in retirement […]

Avoid This Retirement Mistake

[vc_row][vc_column][vc_video link=”https://youtu.be/K75ckiivCK0″ css=”.vc_custom_1675820724100{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Retirement is a time to kick back, relax, and enjoy the fruits of your labor, but it’s also important to be careful with your finances. One mistake we often see is the lack of planning for major purchases, such as buying a new car. Now, we know what you’re […]

How to make retirement withdrawals in a bad market

[vc_row][vc_column][vc_video link=”https://youtu.be/uj4W_H8q118″ css=”.vc_custom_1673225605045{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]When the stock market goes through a bad year, it becomes increasingly difficult to make withdrawals from your portfolio. So, what’s the best way to make retirement withdrawals during a bad market? We’re all familiar with the investing adage to buy low and sell high, but without proper planning, […]

10 Positives Going Into 2023

[vc_row][vc_column][vc_column_text]It’s always nice to hear positive news. So as we head into 2023, here are a few things to look forward to 10 Positives Back-to-back negative stock market years are rare having only occurred 9% of the time since 1928. Although still high, inflation has been decreasing over the past 6 months 2023 […]

Can You Retire on $750,000?

[vc_row][vc_column][vc_video link=”https://youtu.be/FCugi2kEmrc” css=”.vc_custom_1673221771632{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]In our second video in this series, can you retire on $750,000, we look at Mr. & Mrs. Wilson’s financial situation. Let’s see what their financial picture looks like. Financial Picture Let’s start with Mrs. Wilson. She is currently 68 years old and has the following, RRIF: $350,000 […]

Extra RRSP Withdrawal

[vc_row][vc_column][vc_video link=”https://youtu.be/gJWERBrGmAQ” css=”.vc_custom_1673040534150{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]As we approach the end of the year, there are a few tax planning strategies that you should consider before the year is out. Let’s look at if it makes sense to make an extra RRSP withdrawal before the end of the year. Tax Planning Strategy #1: RRSP/RRIF […]

What Happens To Your CPP When You Pass Away?

[vc_row][vc_column][vc_video link=”https://youtu.be/u2C_F79nlS4″ css=”.vc_custom_1672961512503{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]What happens to your CPP when you pass away? Let’s assume that both you and your spouse are receiving CPP; what would happen if one of you were to pass away? How CPP is calculated Before we can get into that, we must first understand how your CPP […]

Deferring Your OAS

[vc_row][vc_column][vc_video link=”https://youtu.be/TQrIlisCLsA”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text css=”.vc_custom_1672760792715{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today we looking at deferring your Old Age Security Pension, whether or not it makes sense, and a major red flag you need to consider if you are going to defer. Eligibility For many people, the Old Age Security (OAS) pension will make up a portion of their […]

Can You Retire On $500,000?

[vc_row][vc_column][vc_video link=”https://youtu.be/XWTUbbWIjRE” css=”.vc_custom_1672428534810{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Can you retire on $500,000? This is the first video in a new series where we will look at whether you can retire on X amount of dollars. Check out our next video, Can you retire on $750,000? Today we’re going to be using Mr. and Mrs. Baker as […]

Should You Wait Until Things Look Better To Invest?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1665601800315{padding-top: 20px !important;padding-bottom: 20px !important;}”]With the recent decline in stock markets, some of you have called looking to take advantage of this drop and buy low. The one question that comes up in every conversation is: “I know I should buy when stocks are down, but should we wait until things start to […]

Retirement Plan Leads to $900,000 in Savings

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/LyARyAqkxqw” css=”.vc_custom_1656081943350{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1656083233452{padding-top: 20px !important;padding-bottom: 20px !important;}”]Here is a real-life example of how two tweaks to a couple’s retirement plan, saved them over $900,000. For this video, we start by going over Donna and Steve’s (names have changed for confidentiality reasons) background and going over […]

Private Home Care

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text]According to a recent survey[1] from CARP (Canadian Association of Retired Persons), nearly 95% of seniors want to stay in their homes as they age. This isn’t overly surprising considering the negative connotation associated with care homes. We all have that relative who we’ve heard say I’d rather ….. than […]

4 Conflicts Faced by Financial Advisors

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/XYdZYMit0o4″ css=”.vc_custom_1654110574687{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1654115009964{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript: 4 Conflicts Faced by Financial Advisors If you are working with a financial advisor, you need to be aware of a few conflicts of interest that can affect your bottom line. Conflicts of interest will arise […]

What is the difference?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/PxNda6ZUKDE” css=”.vc_custom_1652892147483{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1652892573120{padding-top: 20px !important;padding-bottom: 20px !important;}”] Different Advisors Investment Advisor versus Mutual Fund Representative versus Portfolio Manager, why does it have to be so confusing? In the world of financial advising, it’s the wild west when it comes to job titles. You’ll see things […]

Are You On Track To Retire?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/T1bZnGQs298″ css=”.vc_custom_1650475923452{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1650476415337{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript: Are you on track to retire? Today, we’re going over how we determine whether clients are on track to retire. Let’s jump into an example. First Thing to Determine Debbie is 57 and looking to […]

3 Reasons Retirement Plans Fail

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/p6Pi6W-1c9A” css=”.vc_custom_1648516766968{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1648521346724{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript Today I want to talk about 3 reasons retirement plans fail. First Reason The first reason your retirement plan can fail is oversimplification. I was speaking with a gentleman a few weeks ago, who was […]

3 Mistakes to Avoid in Retirement

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/uzqJ7O71kXQ” css=”.vc_custom_1647281483668{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1647961428693{padding-top: 20px !important;padding-bottom: 20px !important;}”]Check out the video above to find out the three mistakes you should avoid in retirement. We also started a new YouTube page recently and would appreciate it if you could subscribe to our channel. You can do so […]

How Is Your Investment Portfolio Taxed?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text] Don’t throw $440k out the window Has a credit card statement ever made you yell out, Holy Moly!!!!! (or insert expletive)? That’s what happened to me last week, and I quickly found myself on a call with my credit card provider. To my surprise, I was apparently treating someone […]

Avoiding the RRSP Tax Bomb

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text] Avoiding the RRSP Tax Bomb I recently met up with some old friends from high school, and we reminisced about some of the good times we had back in the day. We got to talking about the time I absolutely bombed during a class presentation. It was a total […]

Health Benefits Plan

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text]While working, most people don’t pay much attention to the cost of their health benefits plan as it’s something they are required to pay into. However, a health benefits plan becomes optional once retired, so make sure you have the proper coverage that fits your needs. You may be […]

Don’t Lose Your O.A.S When Selling

[vc_row][vc_column][vc_video link=”https://youtu.be/DiEBoSqCAvE” css=”.vc_custom_1630363492987{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1648655591004{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this video, I go over what Old Age Security is when the clawback starts, and a scenario where you sell your farm and the clawback will likely occur.[/vc_column_text][/vc_column][/vc_row]

Personal Care Homes: The hidden cost

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text]As I’ve outlined in the past (Die with Zero), I’m an advocate for spending more in retirement and enjoying life while you’re healthy enough to do so. I also believe in aggressively drawing down taxable accounts such as RRSPs and RRIFs (RRSP Tax Bomb) to potentially avoid a significant tax […]

How to Tackle Inflation

[vc_row][vc_column][vc_column_text] I just paid $100 for a chocolate bar! Some of you may remember when inflation hit double digits in the ’80s. Back then, paying 15% on your mortgage was reasonable, and Canada savings bonds were doubling your money every five years. When the cost of goods goes up, it has many effects. Only time […]

Easy Retirement Plan

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text css=”.vc_custom_1622528651185{padding-top: 20px !important;padding-bottom: 20px !important;}”]The finish line is just around the corner; what should you be doing as you approach retirement? Here are 5 steps to an easy retirement plan 1. Determine how you want to spend your time? In my experience, there are two reasons people choose […]

Farm Corporations & RRSPs

[vc_row][vc_column][vc_video link=”https://youtu.be/E13JbAW0gvw” css=”.vc_custom_1617129005089{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1616981501445{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this week’s video we review at what income levels it makes sense to make RRSP contributions if you’re incorporated. CLICK HERE for my previous RRSP video: Farmers & RRSPs [/vc_column_text][/vc_column][/vc_row]

Starting Your Farm Transition

[vc_row][vc_column][vc_video link=”https://youtu.be/gJfTuO-6b2Y” css=”.vc_custom_1615866353860{border-radius: 2px !important;}”][vc_column_text css=”.vc_custom_1616085713206{padding-top: 20px !important;padding-bottom: 20px !important;}”]Our video this week is an interview with “Canada’s Farm Whisperer” Elaine Froese. Get in touch with Elaine by visiting these links: https://elainefroese.com/ https://elainefroese.com/virtual-kitchen-table/ Background Image by Anna Workman, Life in Bloom Photography. [/vc_column_text][/vc_column][/vc_row]

Farmers and RRSPs

[vc_row][vc_column][vc_video link=”https://youtu.be/3jWpwJTQZZI”][vc_column_text css=”.vc_custom_1615307723455{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this week’s video, we go over how to properly use RRSPs as a farmer.[/vc_column_text][/vc_column][/vc_row]

RRSP Tax Bomb

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/yd1jwxKchYI”][vc_column_text css=”.vc_custom_1639420006496{padding-top: 20px !important;padding-bottom: 20px !important;}”] One of the biggest issues with an RRSP is the tax bomb it can create. We first go over the Canadian tax system to understand why this tax bomb can happen and then a strategy on how to avoid it! How can you […]

A Capital Gains Exemption Quirk

[vc_row][vc_column][vc_video link=”https://youtu.be/CqypqnZB0FA”][vc_column_text css=”.vc_custom_1613672399507{padding-top: 20px !important;padding-bottom: 20px !important;}”]If you’re not a farmer, but you own farmland that qualifies for the capital gain exemption, make sure you don’t pass away before using the exemption![/vc_column_text][/vc_column][/vc_row]

What is a reverse mortgage

[vc_row][vc_column][vc_video link=”https://youtu.be/kcx3bQ_zx1o” css=”.vc_custom_1615868350972{padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;border-radius: 10px !important;}”][vc_column_text] What is a reverse mortgage Where were you when you first heard the term reverse mortgage? If you’re like me, it was through a cheezy commercial on day time TV. Because of this, I was always skeptical of these products, and I […]

The Easiest Way to Reduce Your Tax Bill

[vc_row][vc_column][vc_video link=”https://youtu.be/nSpI2-dtGPw” css=”.vc_custom_1633105309436{padding-bottom: 20px !important;}”][vc_column_text] The Easiest Way to Reduce Your Tax Bill Click above to view video! Thank you for watching our video.[/vc_column_text][/vc_column][/vc_row]

Financial Advisors: Are They All The Same?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1611704668102{padding-bottom: 20px !important;}”] Are All Financial Advisors the Same? The 3 Types When choosing a financial advisor, it can be challenging to differentiate between all available options. They all say: “I’ve been doing this for X years, and my returns have been stellar.” But what else should you be considering beyond returns? While all […]

Gifting the Farmland

[vc_row][vc_column][vc_video link=”https://youtu.be/BY5NKn3F2Sc” css=”.vc_custom_1630350208840{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Gifting the Farmland In this week’s video we review the different ways you can gift farmland to your children along with the pros and cons of both methods.[/vc_column_text][/vc_column][/vc_row]

Investment Strategies for NHLers

[vc_row][vc_column][vc_column_text] Investment Strategies for NHL Players You’re playing in the NHL, so naturally you’re making a lot of money at a relatively young age. The average person will work for 25-30 years, and slowly increase their income as they get older. In contrast, an NHL career averages only 5 years, and is highly lucrative in […]

Should I Be Buying RRSPs?

[vc_row][vc_column][vc_video link=”https://youtu.be/WCWwAhFa7kY” align=”center” css=”.vc_custom_1612464257262{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Should I Be Buying RRSPs? The answer to that question is going to depend on a few different factors. This latest video can help you understand whether or not investing in RRSPs is the right decision for you. [/vc_column_text][/vc_column][/vc_row]

How Do Pro Athletes Go Broke?

[vc_row][vc_column][vc_column_text] How do pro athletes go broke? “If you’re playing in the NHL, you’ve got a pretty good life” These were the words spoken by Paul Maurice after an NHL player poll slated Winnipeg as “the most dreaded road trip.” As a proud Winnipegger, hearing how our “great” city is actually the worst place to […]

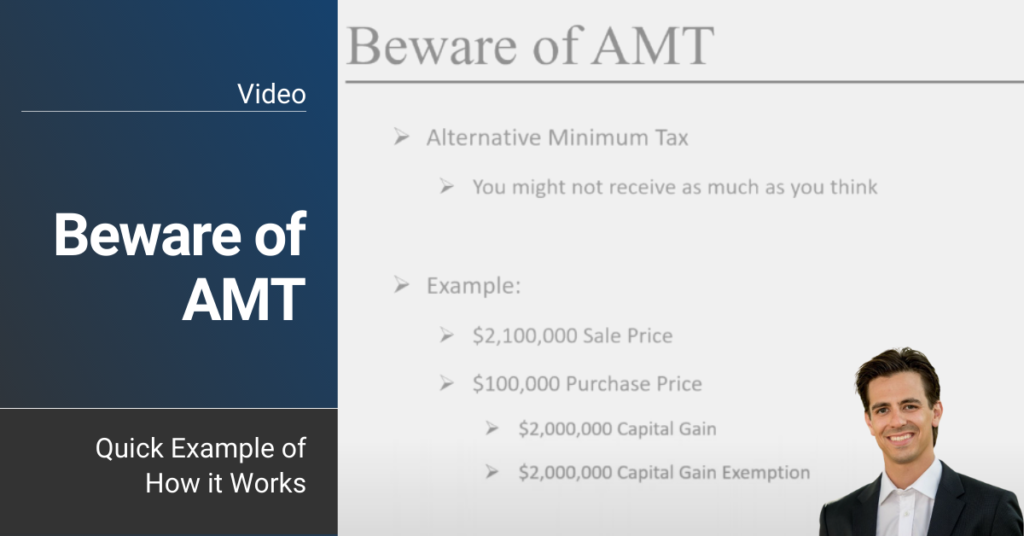

Beware of AMT

[vc_row][vc_column][vc_video link=”https://youtu.be/NOzkZQx7Fjw” css=”.vc_custom_1630350334573{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][vc_column_text css=”.vc_custom_1630350311731{padding-top: 20px !important;padding-bottom: 20px !important;}”] Beware of AMT Here is a quick video on what alternative minimum tax is and how it works. Enjoy![/vc_column_text][/vc_column][/vc_row]

Too Much Cash in Your Corp!

[vc_row][vc_column][vc_video link=”https://youtu.be/exR8blXVnOA” css=”.vc_custom_1630350554688{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Too much cash in your corp See my latest video going over a case study where one farmer thought his farm corporation qualified for the lifetime capital gains exemption but didn’t due to having too much cash.[/vc_column_text][/vc_column][/vc_row]

Tax Planning Strategies: Dealing with Capital Gains (Part 4)

[vc_row][vc_column][vc_column_text] Wanda has been investing for a long time and is quite familiar with buying when prices are low and selling when prices are high. Past non-registered account purchase In 2010, she had purchased $100,000 of ABC Corp, and today, it’s worth $250,000. Wanda is now ready to sell her investment as she believes the […]

Your First Investment Property: Tips for Financing

[vc_row][vc_column][vc_column_text] Guest Post by Property Pillar Management. They provide residential and commercial property management in Winnipeg, Manitoba and surrounding areas. From small single family homes to apartment blocks to commercial spaces. Buying an investment property in Canada is one of the best ways to diversify your assets. In addition to the promise of earning […]

Let’s Multiply Your Capital Gains Exemption

[vc_row][vc_column][vc_video link=”https://youtu.be/VqzR8GWy8mY” css=”.vc_custom_1630352006724{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Let’s Multiply Your Capital Gains Exemption As a farmer, you have a lifetime exemption of one million dollar on the sale of farmland. If you exceed that amount, you could be looking at a large tax bill. Here is an option to increase your capital gains exemption. In this video, we will show two things. First, when no plan is in place and the ensuing tax bill. Second, […]

Tax Planning Strategies: 4 Strategies You Should Implement this Year (Part 1)

[vc_row][vc_column][vc_column_text]Much like the summer months, December seems to come and go in the blink of an eye. We’re all so busy with work events and family gatherings that year end tax planning often gets neglected. With COVID forcing most of us to stay home this year, we can all use this opportunity to make sure […]

Managing Your Portfolio in Retirement

[vc_row][vc_column][vc_column_text]https://youtu.be/3mwAUqolv20 Managing Your Portfolio in Retirement The financial industry tends to make things more complex than they need to be. As a result, topics like this usually go in one ear and out the other. My aim with this webinar is to simplify this topic by providing an explanations (in simple English). This webinar will cover topics to be aware of as you approach or […]

Farm Retirement Planning – Option 1: Don’t Sell the Farm

[vc_row][vc_column][vc_column_text]Farmland has been one of the best investments in Canada for the past 25 years.This is clearly shown by an annual growth rate averaging over 5% (as per FCC). If looked at as potential rental income, farmland generates around 7% in annual returns without the wild ride of investing in alternative asset classes. To make […]

US Elections – Should you make moves in your portfolio?

[vc_row][vc_column][vc_column_text]The US election is weeks away and there is no shortage of predictions on how the winner will impact the markets and economy as a whole. Although our natural reaction is to guess how the outcome of the election will impact your wealth, it becomes a futile exercise when we realize how much there is […]

Retirement: What You Need to Know

[vc_row][vc_column][vc_column_text]https://youtu.be/6UwIGk_WKoU You’ve worked hard for decades, and now that you are approaching or entering retirement, you could find yourself exposed to significant taxes without the proper strategies in place. Keep more of what you’ve built and enjoy the retirement you deserve. This complimentary video will cover the following topics: Am I on […]

The GIS Strategy: How To Receive Tax-Free Income

[vc_row][vc_column][vc_video link=”https://youtu.be/4RmIFXCjoaM” css=”.vc_custom_1615868841483{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]As an Investment Advisor and Certified Financial Planner, I’m relied upon to reduce my client’s tax bill as much as possible. Today, I wanted to share with you a strategy that, if implemented correctly, can see your family receive nearly $140,000 tax-free from the government. That’s a lot of […]

The Market Has Never Taken a Dollar from Anyone

[vc_row][vc_column][vc_column_text] The S&P 500 rises to a record close, fully wiping out its coronavirus losses With the US market hitting a new all-time high yesterday, I wanted to review one of my favorite sayings when it comes to investing: “The Market Has Never Taken a Dollar from Anyone” Whenever I mention this to new investors […]

Getting The Best Of Both Worlds From Your Pension

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=lqV8Ehobmkc Wouldn’t it be great to have the benefits of commuting your pension as well as the benefits of a monthly pension? In this brief video, I go over how you can have the best of both worlds. As always, if you’d like to discuss your personal situation and explore your financial options, feel free […]

How Commuting Your Pension Allows You To Manipulate Your Income

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=TrjWlPOqz2w&feature=youtu.be Deciding between commuting your pension or opting for the monthly income stream is a big retirement decision that contains several complexities. In this brief 3-minute video I provide clarity on the benefits of taking the commuted value compared to the monthly income stream. If you’d like to discuss your personal situation and explore your […]

Understanding the Proposed CSSB Pension Changes

[vc_row][vc_column][vc_column_text css=”.vc_custom_1611896333374{padding-bottom: 20px !important;}”]https://youtu.be/2r5I0HeZNa4?t=2 *It was expected that Bill 43 would receive Royal Assent (Approval) when the Legislature reconvened in the fall. However, since the Throne Speech was moved up to October 7th, the bills that were being discussed during the spring session have been put on pause. Because of this, the status and timing […]

Why are markets going up?

Over the past few weeks, I’ve been having this discussion with clients. Why does the market continue to rise while unemployment in the US is sitting at 40 million (the size of Canada’s population), and most businesses aren’t even close to running at 100% capacity? Everyone has their opinions and theories as to what is […]

Significant changes being proposed to the CSSB pension

[vc_row][vc_column][vc_column_text css=”.vc_custom_1615397984394{padding-bottom: 20px !important;}”]*Bill 43 received Royal Assent (Approval) when the Legislature reconvened in October 2020. If you have a CSSB pension, there could be significant changes coming that will affect how the commuted value of your pension is calculated. As I’ve mentioned in the past (Pension or Lump Sum, How to Decide), you […]

Financial Advice for Manitoba Hydro Employees

[vc_row][vc_column][vc_video link=”https://youtu.be/6lPhNQyQ1Zk” css=”.vc_custom_1615869473595{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1611901511867{padding-bottom: 20px !important;}”]I’ve had the pleasure of working with several clients who work or have retired from Manitoba Hydro. While each person’s financial situation is different, some commonalities exist amongst those sharing and employer. This guide identifies those shared characteristics and provides advice regarding their financial planning implications. […]

Approaching Retirement: 5 things you need to look at

[vc_row][vc_column][vc_column_text css=”.vc_custom_1612244179887{padding-bottom: 20px !important;}”]What once seemed so far away is now within reach. You’ve been working most of your adult life, and you can finally see the light at the end of the tunnel. Retirement! The question now becomes, are you ready? Here’s a list of 5 things you need to look at as you […]

My uncensored opinion about RRSPs if you have a pension

[vc_row][vc_column][vc_column_text css=”.vc_custom_1612815094599{padding-bottom: 20px !important;}”] Psychologists call this phenomenon the “illusionary truth effect.” According to Psychology Today, “When determining whether a given claim is true, we don’t always critically evaluate sources or search for corroborating evidence. Instead, we often intuitively evaluate whether a certain claim feels true. And a claim feels more “true” if it comes […]

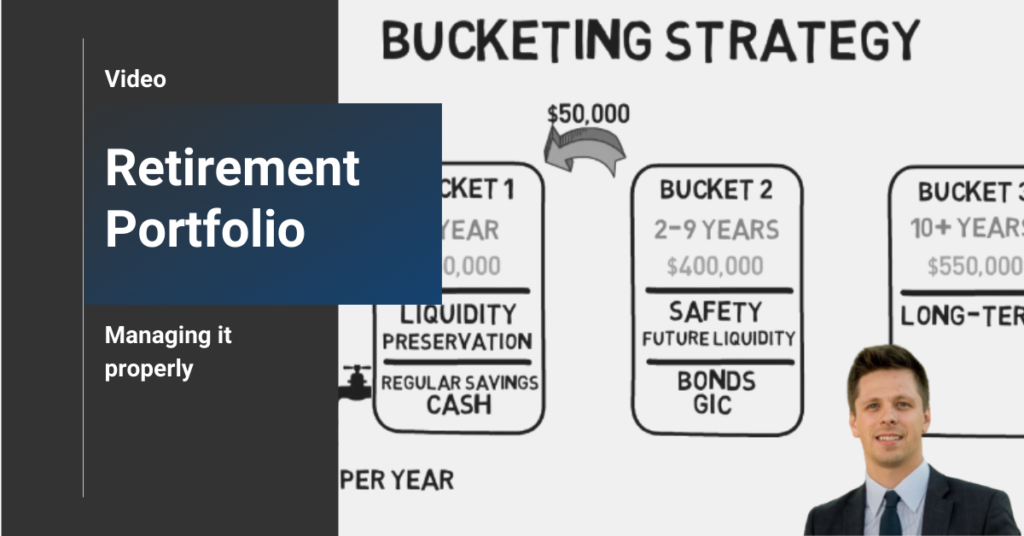

How to properly manage a retirement portfolio

[vc_row][vc_column][vc_column_text]https://youtu.be/q9N2DAt0Djk Are you tired of turning on the nightly news and worrying about how the day’s events are affecting your retirement portfolio? Are you worried about the day-to-day fluctuations of the stock market? This week we take a look at how to properly manage your retirement portfolio with the Bucketing Strategy so that you […]

Important considerations to make before accepting an early retirement package

[vc_row][vc_column][vc_column_text]Companies will often offer employees early retirement packages to encourage them to retire. This is usually done when the company is looking to cut costs and reduce staff. Before making a decision, there are many questions to be addressed. All of which are specific to individual preferences and circumstances. Here are eight such considerations to […]

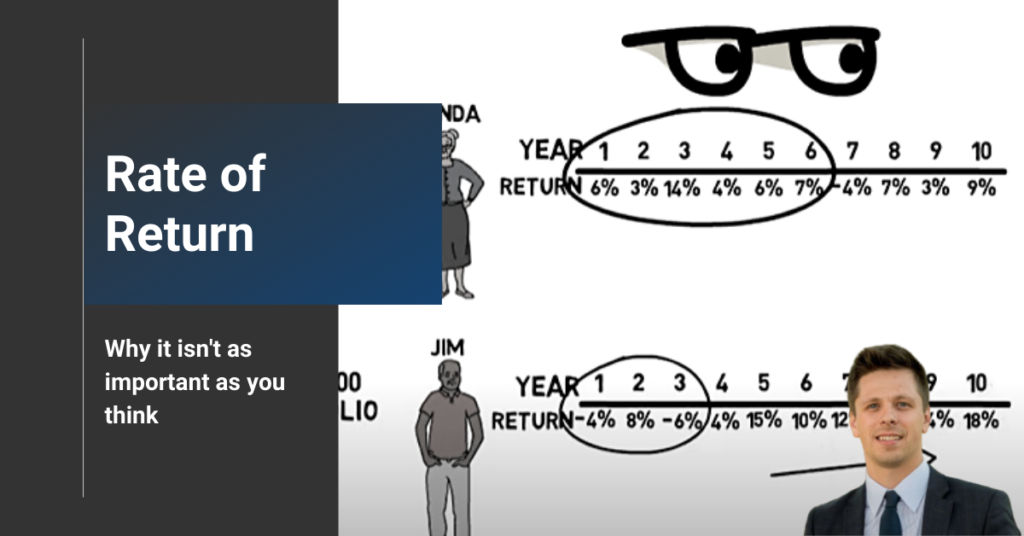

Why your rate of return isn’t as important as you think

[vc_row][vc_column][vc_video link=”https://youtu.be/SDGXOkQjgxE” css=”.vc_custom_1623956167399{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Rate of return vs timing of return Many people believe that the rate of return they earn in their investment portfolio is the number one factor in determining the success of their retirement plan. Although essential, today I want to review why it’s even more important not to […]

5 Reasons you should keep your monthly pension

[vc_row][vc_column][vc_column_text]Over the last couple of months, we’ve taken a look at some of the reasons you should withdraw the commuted value from your defined benefit pension plan. (See: Five reasons you should take your pension as a lump sum payout and What happens when you withdraw your pension?) The best strategy always depends on personal circumstances, […]

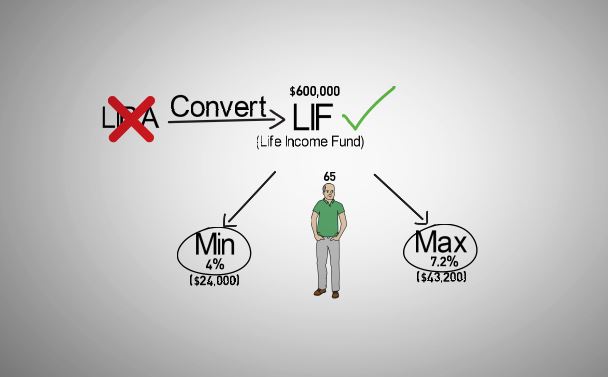

What happens when you withdraw your pension?

[vc_row][vc_column][vc_column_text]https://youtu.be/JcziaDS5R2M Today we’ll be going over what happens when choosing the lump sum payout option from your defined benefit pension plan. As you’re likely aware, a defined benefit pension plan will pay you a monthly income for life, so why choose the lump sum payout option instead? A few common reasons include: Pension […]

Is life insurance an investment or expense?

Are you thinking about purchasing life insurance as a succession planning tool, but having trouble wrapping your head around the annual costs? You might be thinking, “I could be using this cash to buy more land, pay off debt, increase my salary, upgrade my equipment, etc.” I get it, insurance isn’t a very exciting topic, […]

Should I buy life insurance today or tomorrow?

[vc_row][vc_column][vc_column_text] Life insurance is one tool farmers use to help equalize their estate. Below is a comparison of the different costs of buying your life insurance today rather than waiting until you’re older. The scenario You have two children. One would like to farm; the other one isn’t interested. You want to make things […]

Five reasons you should take your pension as a lump sum payout

[vc_row][vc_column][vc_column_text] If you’re planning to leave your employer due to your retirement or a change in career paths, then you may be faced with the decision to either take your pension as a lump sum or as a monthly income. What is a defined benefit plan? A defined benefit plan promises to pay a pre-determined […]

How to supercharge your RRSP

[vc_row][vc_column][vc_column_text] Don Jacobs is three years away from retirement and is looking for a way to supercharge his RRSP. With the 2018 RRSP deadline just around the corner, we help Don maximize his contributions so he can achieve his retirement goal in the next three years. Now that Don’s contribution has been […]

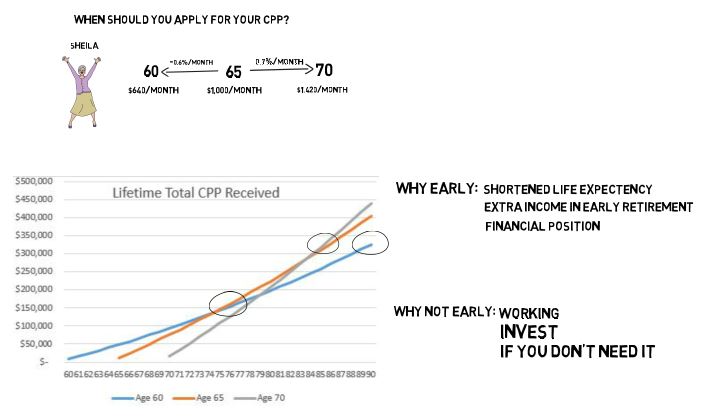

When should you apply for your CPP?

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=-WEtYpTdysg&feature=youtu.be When should you be applying for your CPP? This week we take a look at the long-term financial impacts of your decision and what variables you should take into consideration. Looking for more advice? Take a look at our 2 part CPP series which includes An argument for taking CPP later and An argument for taking […]

How much do I need to save for retirement?

[vc_row][vc_column][vc_column_text]When I first started working in the financial industry over 3,000,000 minutes ago, one of the common rules of thumb was that you needed to save 20% of your income for your retirement. I immediately began to question this advice as it seemed too simple to implement, not to mention an extreme generalization. Imagine if […]

Start your succession planning with the basics

Don’t wait until you have all the answers before you start working on a succession plan. As farm advisors, we often get questions like “How much does insurance cost for someone like me? What would the tax consequences be if I transferred land to my children? If I sell my land and invest the proceeds, […]

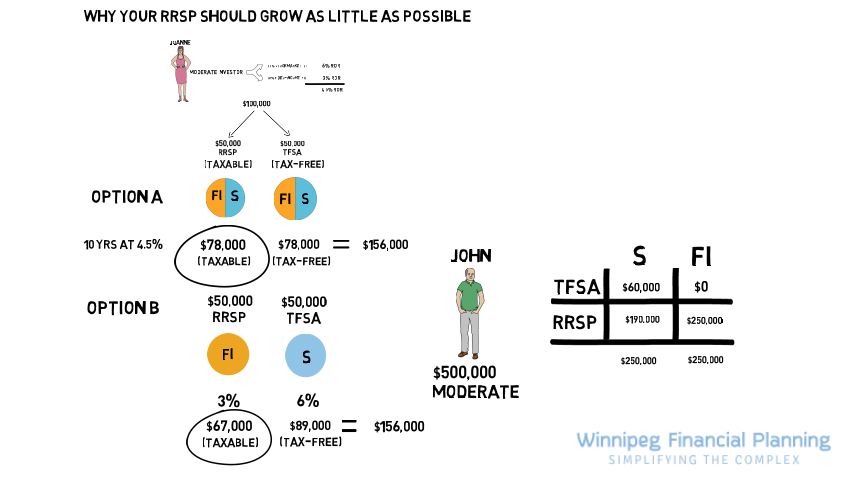

Why your RRSP should grow as little as possible

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=RFAZL6qPwkE&feature=youtu.be Is your portfolio properly structured to minimize tax? Can I keep more money in my pocket without increasing the risk in my portfolio? Find out why your RRSP should grow as little as possible in this week’s video. Enjoy videos? Check out the Video Category for more great strategies. [/vc_column_text][/vc_column][/vc_row]

Can I retire if I still have debt?

[vc_row][vc_column][vc_column_text]More and more Canadians are retiring with debt, but does that make it a viable solution for your retirement plan? We would all like to be debt free once we retire but it isn’t always possible. Ask yourself this The big question you need to ask yourself is “How was the debt accumulated?” If you […]

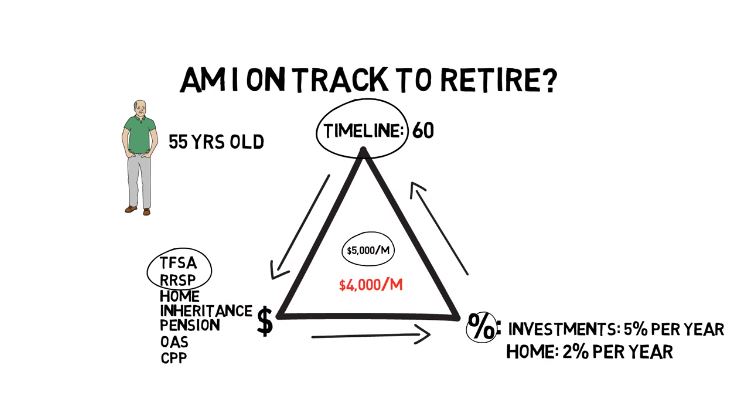

Am I on Track to Retire? – Video

Am I on track to retire? This is a very common question I receive, so today I wanted to give you a simple way that you can get an answer to this question without pulling your hair out. Bob is 55 years old and approaching retirement. He plans on spending his winters in Phoenix and […]

Get the most out of your retirement savings

Sometimes withdrawing more is the best strategy. Introducing Daniel Daniel worked hard all his life, so by the time he retired he had accumulated a healthy amount of savings in his RRSP. It’s not because Daniel had an overabundant cashflow. There were years where he had to choose between replacing his TV or contributing to […]

Generating retirement income from your farmland

Entering retirement with farmland that you can use to generate rental income is a great way to create a steady income. However, there are a few points to consider to make sure you’re generating enough income and being as tax efficient as possible. Have a plan Unfortunately, land isn’t like a savings account. If you’re […]

Timing your Retirement to Save Tax $$$

You’ve been targeting the unreduced pension date that you’ve seen on your yearly pension statement for the last twenty years. It’s finally within arm’s reach and you are set on retiring on that exact date. You’ve put in the time and you’re tired of hearing Carl’s nonsense about the Jets around the water cooler. As […]

Pension or Lump Sum? How to Decide

For those of you lucky enough to have a defined benefit pension plan, you may have to decide whether to take your pension as a monthly income or as a lump sum payout upon retiring. There isn’t a universally accepted answer when deciding between these two options, as it mostly depends on your personal circumstances. […]

An Argument for Taking CPP Early

Last month I wrote and article arguing why it makes sense to take CPP later. This month we will review the argument for taking it early. As I mentioned last time, everyone seems to have an opinion on the matter but few people realize that this isn’t a “one size fits all” problem. If you […]

An Argument for Taking CPP Later

In this 2-part series, we will explore both sides of the age-old question “should I take CPP (Canada Pension Plan) earlier or later?” We’ve all met purported CPP experts at some point in our lives. It may have been a member of your family, your plumber, or your dentist. The fact is that everybody has […]