[vc_row][vc_column][vc_column_text css=”.vc_custom_1612815094599{padding-bottom: 20px !important;}”]

Psychologists call this phenomenon the “illusionary truth effect.” According to Psychology Today, “When determining whether a given claim is true, we don’t always critically evaluate sources or search for corroborating evidence. Instead, we often intuitively evaluate whether a certain claim feels true. And a claim feels more “true” if it comes to mind with fluency and ease, leading us to mistake what is familiar for what is true.”

In my role as an advisor, I primarily help those who are approaching retirement and have a work pension plan. Whenever I meet someone new, I like to go over their financial situation to get an idea as to where they currently stand. When bringing up RRSPs, I’ve been told on numerous occasions, “I don’t need RRSPs, I already have a pension plan.”

When asked where they received this information, people will say, “ I don’t know, that’s what I’ve always heard.” I began to question my financial planning knowledge after hearing this so many times. Do they know something that I don’t, or is this an example of the illusionary truth effect?

Reviewing the evidence

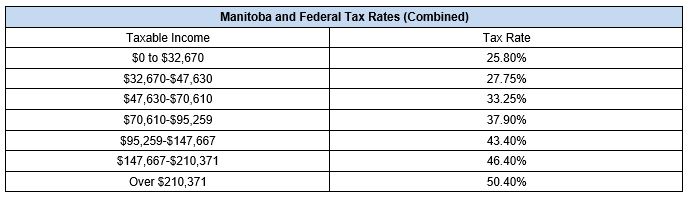

At its core, a contribution to an RRSP will reduce your taxable income by your corresponding marginal tax rate. For example, if you make $100,000 per year you will fall under the 43.4% marginal tax bracket as per the combined 2019 Manitoba and Federal tax rates.

If you make a $4,000 contribution to an RRSP, your taxable income will drop to $96,000. This would result in a tax refund of $1,736 ($4,000 x 43.4%).

Let’s assume that when you retire, you’ll have an income of $60,000 per year including your pension, CPP, and OAS payments. When you withdraw that same $4,000 from your RRSP, it gets added to your income. This would increase your income from $60,000 to $64,000, and you would fall under the 33.25% tax bracket. This $4,000 withdrawal from your RRSP would cost you $1,330 ($4,000 x 33.25%) in taxes.

In this case, you would have tax savings of $1,736 when the $4,000 was deposited into your RRSP, and you would pay $1,330 when that same $4,000 was withdrawn from the RRSP. That’s a difference of over $400 in your pocket!

Putting an end to the “illusionary” cycle

If you’ve been part of the pension your whole working career, you may not have much RRSP room available, but if you do and you’re in a higher tax bracket today compared to the tax bracket you’ll be in upon retirement, then RRSPs will continue to make sense even if you have a pension.

The next time you hear a coworker mention that RRSPs don’t make sense for pensioners, ask them where they heard that. If they tell you “that’s what I’ve always heard,” feel free to let them in on the illusionary truth effect.

[/vc_column_text][/vc_column][/vc_row]