Because you only get one chance to do it right.

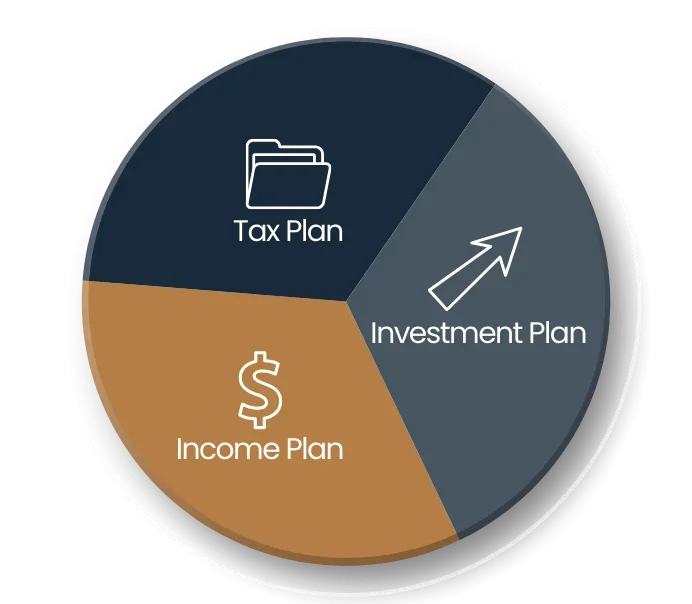

Our One Retirement Process is designed to help you navigate the three areas retirees are most concerned with in retirement:

By combining all three of these areas equally (unlike most firms that only provide investment management), you can be confident all areas of your finances are covered. The end result: The One Retirement Plan.

We will analyze your current retirement trajectory and project your portfolio’s income potential considering factors like personal and government pensions along with any professional corporations and debt that may exist. In the process, we will identify opportunities for improvement. We will ensure you have a plan to maximize your income and minimize your taxes, so you can enjoy financial freedom during your retirement. You’ll also see a projection of your income and net worth throughout the entirety of your retirement as well as what you could potentially leave behind as your estate.

For most individuals, taxes will be their most significant expense both today and in retirement. We want to ensure you have a sound strategy in place to make sure that you don’t pay more tax than necessary. Tax efficiency is one of the most important aspects to financial well being. We often work in concert with accountants and lawyers to make sure you’re in the best possible position. With over 40 tax strategies at our disposal, we will find a way to keep more money in your pocket.

Once we understand your goals and have a plan to maximize your income, we’ll put together an investment portfolio to achieve your ideal retirement. We will ensure you are comfortable with our investment approach and provide you with an understanding of how your portfolio is invested.

We begin by scheduling a conversation to get to know you, your family, and your financial journey. This is where we explore what truly matters to you financially and identify specific goals. This conversation helps clarify your financial priorities and determines if we’re the right fit to help you achieve them. If so, we’ll arrange a follow-up meeting to gather more detailed financial information.

Next, we’ll collect all the essential information needed for an in-depth analysis. During this stage, we’ll share initial insights and highlight any opportunities you might be missing. You’ll gain a clear picture of where your financial path is currently leading. We’ll provide a document to guide you in gathering the necessary data, ensuring the process is smooth and straightforward.

Finally, we’ll present tailored recommendations and alternative strategies in the key areas of retirement planning:

We’ll also address Estate and Health Care planning if needed. After this discussion, you’ll have a comprehensive plan and the confidence to decide if we’re the right partner to guide you in your financial future.

Throughout our relationship, you’ll receive a detailed analysis of where you are at in your retirement plan, whether changes need to be made, and a list of items for future consideration.

When you work with us at Trans Canada Wealth, you don’t just get a financial advisor. You get an entire team. While you will have a primary advisor, we collaborate regularly on the monitoring and review of each of our client’s retirement plans.

We will contact you to schedule semi-annual meetings via phone, virtually in a video call, or in-person to review and update your One Retirement Plan.

You will receive a detailed analysis of the results achieved and a sensitivity analysis/probability of success ensuring that your plan remains on track.

Between meetings, we will continue to monitor your plan and make changes as needed; because however projections and trajectories look on paper, life rarely happens in a straight line. We are always available to discuss any sudden or unplanned changes in your circumstances.

Your New Client Package will have all the necessary information you’ll need to contact us. Life happens and circumstances can change quickly. We want you to feel comfortable contacting us by phone or email as needed.

We also send out quarterly newsletters to clients which include everything from market updates to client and/or advisor personal stories.

There is no cost for an initial conversation.

We simply want to chat about your needs, provide some information about what we do, and determine if we can help you achieve your goals.

We charge a fee based on a percentage of the investments we manage for you. This fee is automatically deducted from your investment account, so there are no extra bills or invoices to worry about. Our fee structure aligns our goals with yours—when your investments grow, we both benefit.

Additionally, all tax, retirement, and estate planning advice we provide is included at no extra cost, giving you comprehensive support without hidden fees

Our mission is to help you get the most out of life. To do that, we strive to take as much of the planning off your plate as possible. Here are the areas we can help with:

When you work with us, we will collaborate with others on your team of experts (e.g., accountants, lawyers, and tax preparers) when necessary, so that all contributors have the full picture.

We want to ensure you feel confident (and excited) about your financial future.

I started working with Colin back in 2015 to put together a plan. Colin has experience, is sharp, and provided me with great ideas. What I admired most, however, was his ability to organize my team of professionals (accountants & lawyers) so we could all work together on tax savings strategies that fit my personal situation.

-Roland G.

We appreciate the diversified approach to helping us manage our finances and make a cohesive plan.

-Bonnie D.

We have been clients for the past few years. We have had many meetings, and everything is always explained thoroughly. We are very impressed with the personalized professional service and advice given to us.

-Cara V.

We have worked with Kevin for the last 20 years and we have been very pleased with the outcome of our financial plan. They have helped us understand our goals and priorities and tailored an investment strategy for the future of our family and business. Needless to say, we are more than satisfied with their approach in keeping our investing on track. Thank you for your excellence!

-Pam & Bruce D.

Trans Canada Wealth Management is headquartered in Winnipeg, MB, and works with clients across Canada, managing over $300 million in assets. We pride ourselves on our out-of-the-box thinking and personalized service. We follow a process for retirement planning with each plan being made for the specific individual.

Having an experienced partner like Trans Canada Wealth Management in your corner helps ensure you have more control over your money than ever before. We’ll help you gain an intimate understanding of your finances.

You can rest well knowing we always have our eyes on your portfolio. You will also have quick and easy access to the status of your portfolio as well as your monthly statements and other documents through our online client portal.

Chartered Investment Managers® and Certified Financial Planners® oversee your investments. You will have a primary advisor working with you, but we also take a whole-team approach to give you the best chance of success.

Assets are protected and insured by National Bank Independent Network.

If you fail to plan, you are planning to fail

-Benjamin Franklin

Fill out the questionnaire below to book your complimentary initial conversation with one of our advisors today.