We connect your income, investments, and taxes through ongoing retirement planning so every part of your retirement works together the way it should.

Retirement raises big questions about income, spending, and reducing taxes. We bring every part of your retirement together so those questions finally get clear answers.

A retirement system designed to eliminate fragmentation and keep everything working together over time

The Atlas System exists because retirement confidence doesn’t come from a one-time plan or a set of disconnected decisions. It comes from having a clear system, one that connects every major financial decision and keeps them working together as life changes.

We help you evaluate what’s possible so you can make informed decisions. From there, our role is to coordinate and oversee the full system. We ensure key decisions remain aligned with the outcomes you’ve defined.

That’s common. Most of our clients came to us while working with another advisor but weren’t getting a plan, tax strategies, or clear answers. The Atlas System helps you compare what you have to what you could have.

No. We don’t believe a one-time document is enough. Our clients rely on us to help them generate steady, tax-efficient retirement income year after year

We don’t sell products or hand you a generic portfolio. Everything starts with a personalized retirement income plan, a structured portfolio to match that plan, and tax strategies—all working together to create steady, tax-efficient retirement income that supports your goals.

We’ll ask about your goals, your savings, and your current plan (if you have one). Then we’ll show you where things stand and what could be improved. No pressure. No cost.

Yes. The next generation is often a key part of creating a tax-efficient retirement income and estate planning. If you believe it would be valuable for us to support your children, we’re happy to help. It’s all part of making sure your full financial picture works together.

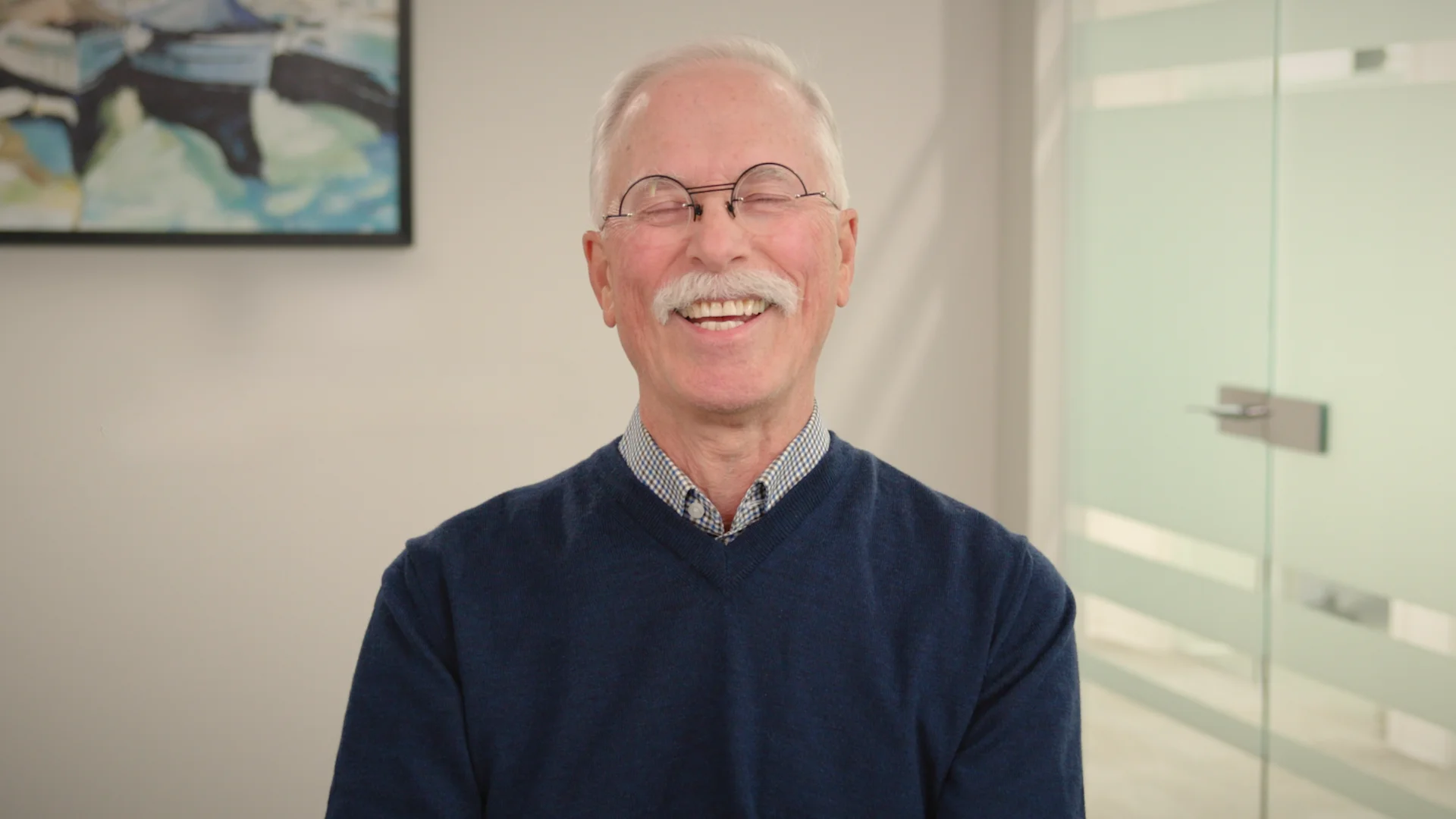

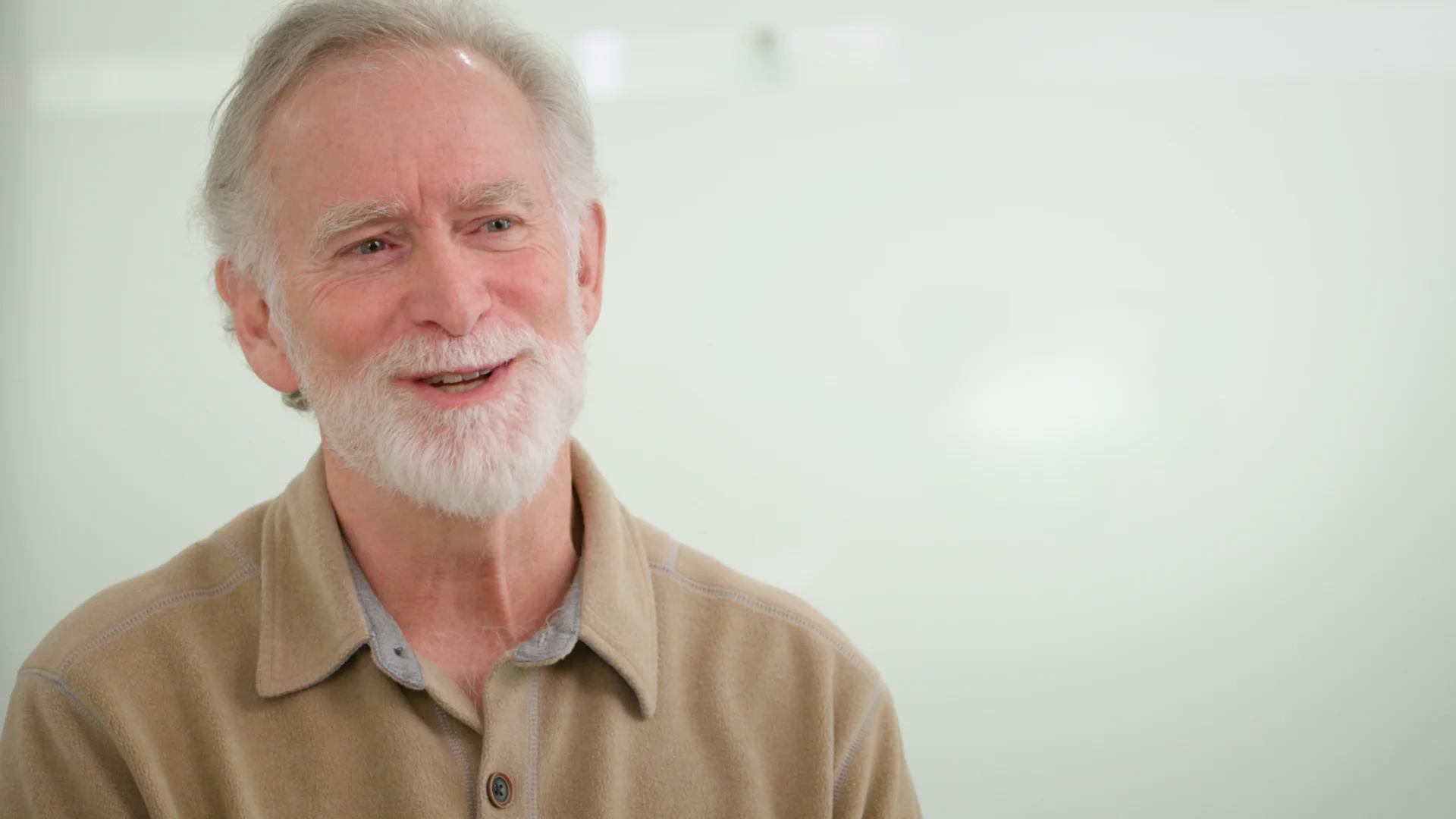

Creating tax-efficient retirement income is what we do. Our team of Certified Financial Planners and Portfolio Managers helps hundreds of Canadians save significant tax dollars throughout their retirement. If you’re wondering who you’d be working with, meet the people behind the plans.

Retirement gets easier when you know what’s coming, how to prepare, and who’s helping you along the way. That’s why every plan we build is personalized, every investment is aligned with your goals, and our team is always there when you need us.

Your retirement plan will be built around your goals, income needs, and lifestyle. never a one-size-fits-all approach.

Your investments will be structured to support your income, reduce taxes, and reflect the way you want to live.

No chasing. No silence. When you reach out, we respond. And when something important comes up, we’ll call you first.

-Joanne & Cindy

No pressure, No cost. Just a clear look at your retirement and how to improve it