Steer Clear of These Two Mistakes in Retirement

Typically I don’t talk about investing in our videos but today I want you to steer clear of these two mistakes in retirement. The two mistakes to avoid are poor portfolio construction not aligning your retirement portfolio with your retirement withdrawal strategy.

Retiring at 55 with 2 Million

What does retiring at 55 with 2 million look like? How much will you be able to spend on a monthly basis? Find out as we discuss Heather’s situation.

Tips for Large RRSP Withdrawals

You’ve done a good job saving and have a sizeable nest egg set aside in your RRSPs for retirement, but how do you make tax-efficient RRSP withdrawals? This is the part that most people get wrong and why you hear so many people say they hate RRSPs. Here are tips for withdrawing from a large […]

Why Living Off Your Portfolio’s Interest in Retirement is Dangerous

What if you could live off your portfolio’s interest without spending any of your principal? Wouldn’t that be something to know that your original capital is still there every time you look at your portfolio? With interest rates higher than they’ve been in years, this seems more possible than ever. However, this can be a […]

Should You Be Buying GICs At These Rates?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/rLE1W8oh4X4″ css=”.vc_custom_1704404291299{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1704405016772{padding-top: 20px !important;padding-bottom: 20px !important;}”]Should you be buying GICs at these rates? We’re seeing rates that we haven’t seen in years, with one-year GICs paying as much as 5.41%. This is the number one question we are receiving from our clients. No joke, […]

Investing After 60

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/az4puajWLAE” css=”.vc_custom_1704403539991{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1704404116083{padding-top: 20px !important;padding-bottom: 20px !important;}”]Investing after 60 doesn’t have to be the complex retirement puzzle the investment industry makes it out to be. How can you invest your retirement portfolio in a simple way so that you can spend your time enjoying life […]

Unlocking the TFSA Secret

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/H0_a4IWwZGk” css=”.vc_custom_1695256838230{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695256848378{padding-top: 20px !important;padding-bottom: 20px !important;}”]Is there a wrong way to use your TFSA? We see it all the time. The result, missed growth and potential tax consequences. What’s the fix? Lets dig into it.[/vc_column_text][/vc_column][/vc_row]

Drawdown Your RRSPs, 3 Reasons Why You Should

[vc_row][vc_column][vc_video link=”https://youtu.be/NHxPmnG3-dA” css=”.vc_custom_1679067241140{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]RRSPs are a popular retirement savings account, but it may be advisable to draw them down aggressively once retired. Here are 3 reasons to aggressively drawdown your RRSPs. RRSP Tax Bomb There are many people out there who hate RRSPs. I often hear stories like, “My parents had […]

Dividends Don’t Add Value

[vc_row][vc_column][vc_video link=”https://youtu.be/HKo6FKD4qz0″ css=”.vc_custom_1677120607021{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Many investors and financial advisors are fond of dividends and base their entire investment strategy on companies that pay dividends. However, it’s time to take a closer look at the reality of dividends and their impact on investment performance. The truth is, and I might be upsetting the dividend-loving […]

Beware Of Buying Investments Before End Of The Year

[vc_row][vc_column][vc_video link=”https://youtu.be/NAx9dCN8dtk” css=”.vc_custom_1673223505786{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]It’s the beginning of December, and Bob has purchased a rental property from his brother. Imagine how unfair it would be if Bob had to pay tax on his brother’s rental income for the entire year. Fortunately for Bob, that’s not the case, but this can happen when you purchase an investment in a non-registered account. […]

Can You Deduct You Financial Advisory Fees?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/L6qNwsjmRvc” css=”.vc_custom_1666203207254{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1666207494765{padding-top: 20px !important;padding-bottom: 20px !important;}”]Can you deduct your financial advisory fees? The short answer, It depends. Today, we’ll be going over the top 3 methods Canadian advisors use to charge their clients and whether or not those methods allow you to deduct their fees […]

Should You Wait Until Things Look Better To Invest?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1665601800315{padding-top: 20px !important;padding-bottom: 20px !important;}”]With the recent decline in stock markets, some of you have called looking to take advantage of this drop and buy low. The one question that comes up in every conversation is: “I know I should buy when stocks are down, but should we wait until things start to […]

Best Questions To Ask A Financial Advisor

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/mYYBXuUOFFY” css=”.vc_custom_1663949989742{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1663950614367{padding-top: 20px !important;padding-bottom: 20px !important;}”]Whether you are looking to hire a financial advisor or already working with someone, there are a few key questions that you should get answered. Let’s dig into these questions and review some of the answers that should raise […]

Should You Be Using More Than One Financial Advisor?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/c0Mw80i-W_g” css=”.vc_custom_1662487692239{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1662487832459{padding-top: 20px !important;padding-bottom: 20px !important;}”]Instances of clients using multiple advisors rose after Bernie Madoff’s Ponzi scheme was revealed during the 2008 financial crisis. However, in good or bad times, multiple advisors can lead to higher fees and lost efficiencies. Ponzi Scheme Protection Nobody […]

Is Now The Right Time To Buy GICs?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/7OfiJJNvXE8″ css=”.vc_custom_1659448945344{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1659449580385{padding-top: 20px !important;padding-bottom: 20px !important;}”] Is now the right time to be buying a GIC? Lets start with, what exactly is a GIC? A GIC is a term investment that pays you a guaranteed interest rate on the anniversary of your purchase. Generally […]

Retirement Plan Leads to $900,000 in Savings

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/LyARyAqkxqw” css=”.vc_custom_1656081943350{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1656083233452{padding-top: 20px !important;padding-bottom: 20px !important;}”]Here is a real-life example of how two tweaks to a couple’s retirement plan, saved them over $900,000. For this video, we start by going over Donna and Steve’s (names have changed for confidentiality reasons) background and going over […]

The Bear Market Playbook

[vc_row][vc_column][vc_column_text css=”.vc_custom_1655224320509{padding-top: 20px !important;padding-bottom: 20px !important;}”]As we find ourselves in a new bear market, let’s review three different strategies for making the most of this market condition. The Bear Market Playbook bases each strategy on a different risk tolerance level. Option 1: Poke the Bear Rebalance Your Portfolio Rebalancing your portfolio is the process […]

4 Conflicts Faced by Financial Advisors

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/XYdZYMit0o4″ css=”.vc_custom_1654110574687{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1654115009964{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript: 4 Conflicts Faced by Financial Advisors If you are working with a financial advisor, you need to be aware of a few conflicts of interest that can affect your bottom line. Conflicts of interest will arise […]

Where Should I Invest?

[vc_row][vc_column][vc_video link=”https://youtu.be/sv3I9T39enc” css=”.vc_custom_1653491806784{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1653493472178{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today I will be discussing an option that business owners have when they have some cash inside the corporation that they do not need to fund their business. The question is “I have some money. Where should I invest? Inside my corporation, or should […]

Capital Gains Exemption for Business Owners

[vc_row][vc_column][vc_video link=”https://youtu.be/qupaHj1vKV0″ css=”.vc_custom_1652890267672{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1652891012280{padding-top: 20px !important;padding-bottom: 20px !important;}”] Cash & Your Capital Gains Exemption Today I want to talk about your corporation and how having too much cash inside of it can inadvertently affect your capital gains exemption if you’re planning on selling. LCGE In 2022, if you sell shares […]

Getting Ready for a Bear Market

[vc_row][vc_column][vc_video link=”https://youtu.be/Pmr4cslrJFI” css=”.vc_custom_1652372880628{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1652373623421{padding-top: 20px !important;padding-bottom: 20px !important;}”] Where are we today? When it comes to the markets, as of today May 10th, 2022, the market is down 15% from its high back on January 3rd of 2022. We are trending downwards so I want to talk to you about what […]

Sell Now And Buy Back Later?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1651241898357{padding-top: 20px !important;padding-bottom: 20px !important;}”] Why don’t we sell and get back in once it’s better? Trust me, I would love to do that for you, but the risk isn’t worth the reward. To begin this analysis, let’s go over your two options Ride the wave Get out and then get back in […]

Book Value vs Market Value

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/A2rkQFWgYVk” css=”.vc_custom_1651091854040{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1651191028909{padding-top: 20px !important;padding-bottom: 20px !important;}”]Book Value vs Market Value If you look at your investment statements, you will see a book value and a market value. Here is a quick explanation of the difference between the two and why it is not the […]

First Home Savings Account

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/McWO2JT4_7A” css=”.vc_custom_1649865864217{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1649866431381{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript: First Home Savings Account Today we’re going over the brand new Tax-Free First Home Savings Account (FHSA), which was recently introduced in the 2022 Canadian Budget. One of the major initiatives of this year’s budget was […]

Investment Questions Part 2

[vc_row][vc_column][vc_column_text]Your Investment Questions Answered Part 2. 2022 is off to a rocky start. What is happening? If you focus on short-term swings in financial markets, you will probably ride the emotional rollercoaster, which will make it difficult to make sound, objective investment decisions. We have certainly seen this going back to Q4 2018, when […]

Our thoughts on the Russian Invasion

[vc_row][vc_column][vc_column_text css=”.vc_custom_1646331106578{padding-top: 20px !important;padding-bottom: 20px !important;}”]The recent Russian invasion has affected us all. From a humanitarian perspective, we hope this war is resolved quickly, and no further loss of innocent life will occur. From a portfolio management perspective, we recognize that these events are reverberating across global markets as investors are trying to assess […]

What should you do?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1645643256609{padding-top: 20px !important;padding-bottom: 20px !important;}”]As the US stock market (S&P 500 index) has officially closed in correction territory (down 10% from its previous high, bear markets are 20% declines), the question is, “What should you do”? To answer this question, we first need to consider – how common are market corrections? How often do […]

Did Your Portfolio Make 21% in ’21?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1643126192582{padding-top: 20px !important;padding-bottom: 20px !important;}”] Did your portfolio make 21% in ‘21? As you begin to receive your 2021 annual reports & statements, one of the questions you should be asking yourself is, “how did I perform in 2021?” Understanding your rate of return is important so up can compare how you stacked up […]

MTAR Accounts for Business Owners

[vc_row][vc_column][vc_video link=”https://youtu.be/7VFfoPw_7gI” css=”.vc_custom_1642018123963{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1642089451799{padding-top: 20px !important;padding-bottom: 20px !important;}”]Are you taking advantage of your corporations to their full capacity? Here is one strategy that may be suitable for your situation. We will use John, a 45-year-old non-smoker for a quick case study. John has $100,000 to invest in his corporation. That investment […]

Tax Season: Part 2

[vc_row][vc_column][vc_video link=”https://youtu.be/bbMEJFP5NQg” css=”.vc_custom_1641915791229{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Tax Preparation In Tax Season – Part 2, I dive deeper into what exactly tax preparation is and what you should look for. Whether you’re a do-it-yourself tax filer or hiring someone to do it for you, it can help you understand what questions you should ask and […]

Tax Season: Part 1

[vc_row][vc_column][vc_video link=”https://youtu.be/NBNQP-936rc” css=”.vc_custom_1640714546631{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Tax season is here Your season is in full swing. It’s a new year and playoffs will be here before you know it. For most North American professional hockey players, tax deadlines and playoffs are around the same time. The timing is not ideal. Instead of waiting until […]

Insurance Coverage in the NHL

[vc_row][vc_column][vc_column_text] Insurance Coverage in the NHL A few weeks ago, I wrote an article explaining some of the special risk insurance options available to professional hockey players. Following that article, I received some questions regarding players’ insurance coverage. Specifically about the coverage through the group-sponsored plan outlined in the CBA. If you’ve read my pension […]

Investment Questions Part 1

[vc_row][vc_column][vc_column_text] Question 1: We’ve had a very good run in stocks. How will we know when the current market is getting long in the tooth and when it is time to get out and go to cash? It is natural for investors to worry about market declines as there have been some very large ones […]

Special Risk Insurance

[vc_row][vc_column][vc_column_text] Better to have Insurance is one of those things that fall in the category of “better to have and not need, then need and not have.” There are numerous types of insurance available such as life, disability, critical illness, home, vehicle, etc. Whether or not you need any of these depends on your personal […]

The Advice You Should Be Getting

[vc_row][vc_column][vc_video link=”https://youtu.be/PyT3PVc-HzE” css=”.vc_custom_1636483097181{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] The advice you should be getting It’s not enough to just receive basic investment and financial advice. Professional hockey players can benefit from a more holistic approach. An approach where the financial advisor facilitates all of the financial options that are available. Let’s use an example. You are […]

The Number One Reason

[vc_row][vc_column][vc_video link=”https://youtu.be/vYPOFcexZig” css=”.vc_custom_1635178579746{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] The Number One Reason Investing will forever see its ups and downs, but over the long term markets have continued to grow. Having a professional in your corner during the tough times (March 2020) will help assess the situation at hand and steer you towards the correct decision. […]

Do You Own Mutual Funds?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/palMyXSrM0o” css=”.vc_custom_1634580487997{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Do you own mutual funds? If so, there’s likely a 98% chance your portfolio has had a below-average performance. [/vc_column_text][/vc_column][/vc_row]

Tax-Free RRSP Withdrawals

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/j94SRt3X5sU” css=”.vc_custom_1633117683533{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]Are Tax-Free RRSP Withdrawals possible? Let me tell you how we are able to do this. Last week, I was sitting down with a gentleman we’ll call John. Like many Canadians, John had buyers remorse regarding his RRSPs. When he went to make a […]

Why Inflation is Killing Your Investment Returns

[vc_row][vc_column][vc_video link=”https://youtu.be/exToZCcxybc” css=”.vc_custom_1632161361839{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1632161933042{padding-top: 20px !important;padding-bottom: 20px !important;}”]Inflation is continuing to be a hot topic these days, hitting 4.1% in Canada. In this video, Colin goes through an example showing how inflation is reducing your buying power, and what can you do with your portfolio to counteract inflation. To read more […]

Use the Bank’s Money

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/yIIr8H6eNjw” css=”.vc_custom_1627402856419{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]In this video, I’ll show you how you can grow your net worth by using the equity already built into your home.[/vc_column_text][/vc_column][/vc_row]

Is Being Low Risk, High Risk?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/9Vwr8DjdLWk” css=”.vc_custom_1626107535062{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]Today we are talking low-risk investments. The assumption is that low-risk investments are the safest option. When in fact, you are losing your purchasing power thanks to low-interest rates and rising inflation.[/vc_column_text][/vc_column][/vc_row]

How to Tackle Inflation

[vc_row][vc_column][vc_column_text] I just paid $100 for a chocolate bar! Some of you may remember when inflation hit double digits in the ’80s. Back then, paying 15% on your mortgage was reasonable, and Canada savings bonds were doubling your money every five years. When the cost of goods goes up, it has many effects. Only time […]

The Farm Transfer Tax Bill

[vc_row][vc_column][vc_column_text css=”.vc_custom_1623123600917{padding-top: 20px !important;padding-bottom: 20px !important;}”] The Farm Transfer Tax Bill C-208 Explained As you may have recently heard, Bill C-208 is proposing to amend the federal income tax act so farm sales to children aren’t taxed at a higher rate when compared to selling the farm to a third party. Many articles explain that […]

Die with Zero

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text css=”.vc_custom_1621958102486{padding-top: 20px !important;padding-bottom: 20px !important;}”] Die with zero: Start spending more today If you ask someone when they plan on taking their Canada Pension Plan (CPP), I can almost guarantee they will want to take it as soon as they are eligible (age 60). The most common reason I […]

Cancel Your Loan Insurance?

[vc_row][vc_column][vc_video link=”https://youtu.be/gugJq5eMFag” css=”.vc_custom_1621352907103{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1621352930446{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this weeks video I go over creditor insurance and how it can be replaced with more cost-effective personal insurance.[/vc_column_text][dt_fancy_image image_id=”5919″ width=”700″ css=”.vc_custom_1621353575577{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Should You Sell Your Home?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text css=”.vc_custom_1621392818438{padding-top: 20px !important;padding-bottom: 20px !important;}”] Should You Sell Your Home? Can you believe how much Tom made selling his house down the street? Chances are, you’ve likely been a part of a conversation such as this one over the last year. The Winnipeg housing market has been red […]

Invest Tax-Free: MTAR Account

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/V9PzignBjxs”][vc_column_text css=”.vc_custom_1620140093905{padding-top: 20px !important;padding-bottom: 20px !important;}”] In Canada, there are three ways you can grow your savings tax-free. Tax-Free Savings Account Principle Residence MTAR Accounts Most Canadians aren’t aware of MTAR accounts and the huge benefits they provide. This is especially true if you plan on leaving funds to […]

Investing at Market Highs

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text css=”.vc_custom_1619537666872{padding-top: 20px !important;padding-bottom: 20px !important;}”]Last week, I spoke about buying into the stock market when prices were low. As we saw, there have been many occasions where it would have been opportune to buy low over the last 25 years.[/vc_column_text][dt_fancy_image image_id=”5617″ width=”1000″][vc_column_text css=”.vc_custom_1619538525428{padding-top: 20px !important;padding-bottom: 20px !important;}”] How about […]

Bitcoin

[vc_row][vc_column][vc_video link=”https://youtu.be/CxEyGmBtZas” css=”.vc_custom_1619501881071{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1619502231933{padding-top: 20px !important;padding-bottom: 20px !important;}”]Our quick thoughts on whether or not you should be adding Bitcoin to your investment portfolio. Here are a couple of links if you are looking for more information on Bitcoin and Cryptocurrencies What are Cryptocurrencies Bitcoin Chart [/vc_column_text][/vc_column][/vc_row]

Should You Always Buy Low?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text css=”.vc_custom_1618867661310{padding-top: 20px !important;padding-bottom: 20px !important;}”]Have you ever heard the term “buy low, sell high?” For those of you who haven’t, this is a simple investment strategy that advocates to buy into the stock market when prices are low and to sell when prices are high. If we look back […]

How to deal with the next stock market correction?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text css=”.vc_custom_1616511375503{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today marks the one-year anniversary of the stock market hitting its bottom on March 23, 2020. At the time, there were still so many unknowns with COVID-19. In fact, the media was still calling it the Coronavirus. A couple of days after the market hits […]

Gamestop: Explained

[vc_row][vc_column][vc_video link=”https://youtu.be/zUlGeTVEc2g”][vc_column_text css=”.vc_custom_1612542540465{padding-top: 20px !important;padding-bottom: 20px !important;}”]See my latest video on the craze that is Gamestop’s stock. I try to keep it simple so you can understand what’s going on and why this is so interesting to watch.[/vc_column_text][/vc_column][/vc_row]

Financial Advisors: Are They All The Same?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1611704668102{padding-bottom: 20px !important;}”] Are All Financial Advisors the Same? The 3 Types When choosing a financial advisor, it can be challenging to differentiate between all available options. They all say: “I’ve been doing this for X years, and my returns have been stellar.” But what else should you be considering beyond returns? While all […]

Taking Care of Your Grandkids

[vc_row][vc_column][vc_column_text] 4 Things you can do to help your grandkids today Traditionally, inheritances have been passed on to the next generation, but as Canadians are living longer than ever, that train of thought is changing. Many people realize that if they live into their early 90’s, that means their kids will likely already be retired. […]

Should I Be Buying RRSPs?

[vc_row][vc_column][vc_video link=”https://youtu.be/WCWwAhFa7kY” align=”center” css=”.vc_custom_1612464257262{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Should I Be Buying RRSPs? The answer to that question is going to depend on a few different factors. This latest video can help you understand whether or not investing in RRSPs is the right decision for you. [/vc_column_text][/vc_column][/vc_row]

Tax Planning Strategies: Dealing with Capital Gains (Part 4)

[vc_row][vc_column][vc_column_text] Wanda has been investing for a long time and is quite familiar with buying when prices are low and selling when prices are high. Past non-registered account purchase In 2010, she had purchased $100,000 of ABC Corp, and today, it’s worth $250,000. Wanda is now ready to sell her investment as she believes the […]

Tax Planning Strategies: Tax-Loss Selling (Part 3)

[vc_row][vc_column][vc_column_text] Tax-Loss Selling Judy bought $400,000 of ABC Bank shares in her non-registered account. Today her ABC Bank shares are worth $375,000, and she is showing a $25,000 loss. Judy plans on holding these shares for the next ten years, so she isn’t overly concerned with the short term drop in her investment. For this […]

Your First Investment Property: Tips for Financing

[vc_row][vc_column][vc_column_text] Guest Post by Property Pillar Management. They provide residential and commercial property management in Winnipeg, Manitoba and surrounding areas. From small single family homes to apartment blocks to commercial spaces. Buying an investment property in Canada is one of the best ways to diversify your assets. In addition to the promise of earning […]

Tax Planning Strategies: 4 Strategies You Should Implement this Year (Part 2)

[vc_row][vc_column][vc_column_text] It’s the beginning of December, and Bob has purchased a rental property from his brother. Imagine how unfair it would be if Bob had to pay tax on his brother’s rental income for the entire year. Fortunately for Bob, that’s not the case, but this can happen when you purchase an investment in a […]

Tax Planning Strategies: 4 Strategies You Should Implement this Year (Part 1)

[vc_row][vc_column][vc_column_text]Much like the summer months, December seems to come and go in the blink of an eye. We’re all so busy with work events and family gatherings that year end tax planning often gets neglected. With COVID forcing most of us to stay home this year, we can all use this opportunity to make sure […]

Managing Your Portfolio in Retirement

[vc_row][vc_column][vc_column_text]https://youtu.be/3mwAUqolv20 Managing Your Portfolio in Retirement The financial industry tends to make things more complex than they need to be. As a result, topics like this usually go in one ear and out the other. My aim with this webinar is to simplify this topic by providing an explanations (in simple English). This webinar will cover topics to be aware of as you approach or […]

US Elections – Should you make moves in your portfolio?

[vc_row][vc_column][vc_column_text]The US election is weeks away and there is no shortage of predictions on how the winner will impact the markets and economy as a whole. Although our natural reaction is to guess how the outcome of the election will impact your wealth, it becomes a futile exercise when we realize how much there is […]

Retirement: What You Need to Know

[vc_row][vc_column][vc_column_text]https://youtu.be/6UwIGk_WKoU You’ve worked hard for decades, and now that you are approaching or entering retirement, you could find yourself exposed to significant taxes without the proper strategies in place. Keep more of what you’ve built and enjoy the retirement you deserve. This complimentary video will cover the following topics: Am I on […]

Investment Ideas After You’ve Sold the Farm

I often receive these types of calls after a farm is sold: What can I invest in that’s going to give me a reasonable rate of return? What can I invest in that is safe? What can I invest in that’s going to match the farm rent I was receiving? There are unlimited options to […]

The Market Has Never Taken a Dollar from Anyone

[vc_row][vc_column][vc_column_text] The S&P 500 rises to a record close, fully wiping out its coronavirus losses With the US market hitting a new all-time high yesterday, I wanted to review one of my favorite sayings when it comes to investing: “The Market Has Never Taken a Dollar from Anyone” Whenever I mention this to new investors […]

How Commuting Your Pension Allows You To Manipulate Your Income

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=TrjWlPOqz2w&feature=youtu.be Deciding between commuting your pension or opting for the monthly income stream is a big retirement decision that contains several complexities. In this brief 3-minute video I provide clarity on the benefits of taking the commuted value compared to the monthly income stream. If you’d like to discuss your personal situation and explore your […]

Why are markets going up?

Over the past few weeks, I’ve been having this discussion with clients. Why does the market continue to rise while unemployment in the US is sitting at 40 million (the size of Canada’s population), and most businesses aren’t even close to running at 100% capacity? Everyone has their opinions and theories as to what is […]

The stock market is down, time to buy?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1612245315281{padding-bottom: 20px !important;}”]As we stay home to contain the spread of the Coronavirus, most of us are guilty of relying on Netflix for some cheap entertainment. My wife recently started watching Grey’s Anatomy, so by association, I was now watching it as well. For those of you who haven’t seen it, the show follows […]

Is Farmland a Good Investment? Part 2

Last week we looked at the cash flow farmland generates (See Part 1). We assumed one acre was worth $6,000 and the rental income was $130/acre. This gave us a rate of return of approximately 2.17% on the rental income. We concluded there were alternative investments with better rates of return (GICs and dividend-paying stocks […]

Is Farmland a Good Investment?

My immediate response would be, who’s asking? An investor or a farmer? Because their goals for the farmland are completely different. Farmers have multiple reasons why farmland would be a good investment beyond simply looking at the rate of return. For this analysis, let’s look at it from the perspective of an investor. This could […]

My uncensored opinion about RRSPs if you have a pension

[vc_row][vc_column][vc_column_text css=”.vc_custom_1612815094599{padding-bottom: 20px !important;}”] Psychologists call this phenomenon the “illusionary truth effect.” According to Psychology Today, “When determining whether a given claim is true, we don’t always critically evaluate sources or search for corroborating evidence. Instead, we often intuitively evaluate whether a certain claim feels true. And a claim feels more “true” if it comes […]

How to gift wealth to your adult children

I was reading the other day that the current cost of raising a child from birth to 17 is about $325,000. And yet, after all that we still want to gift them our wealth?!?! We must be crazy! But having had a child in the last year, I get it. There’s nothing a parent wouldn’t […]

50 Investing Guidelines To Follow

Consider these two stocks. Over the last five years, Stock “A” has seen its share price sputter with a negative return of 3.19%. Over that same period, its revenue growth ranks dead last compared to its competitors. Its historical valuation multiple also ranks last, which indicates that its competitors have a greater opportunity for growth. […]

Investing after you’ve sold the farm

You’ve done your tax and succession planning, you’ve had the big farm auction, and your farm is sold. You’ve given some money to the kids, you’ve paid off your debt, you’ve made a few charitable donations, and you’re left sitting with $2,000,000 in cash. Now you’re left wondering, “Where do I even begin with this […]

How the news can negatively affect your portfolio

[vc_row][vc_column][vc_column_text]Do you recall the last time you turned off the nightly news and told yourself, “I feel great about where the world is headed!”? It’s probably been a long time. You’ll be hard pressed to come away with one feel-good story because the fact of the matter is these stories don’t sell. Don’t buy into […]

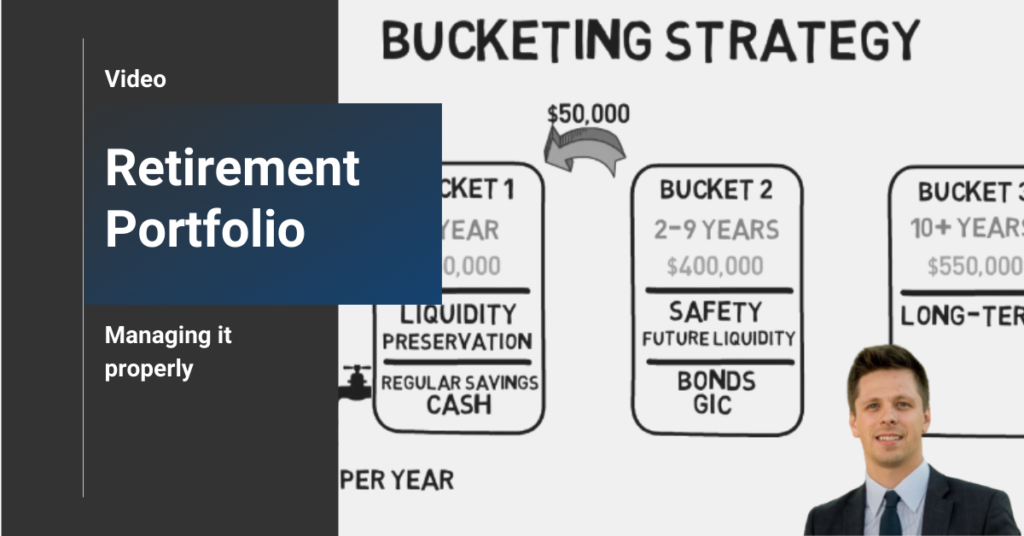

How to properly manage a retirement portfolio

[vc_row][vc_column][vc_column_text]https://youtu.be/q9N2DAt0Djk Are you tired of turning on the nightly news and worrying about how the day’s events are affecting your retirement portfolio? Are you worried about the day-to-day fluctuations of the stock market? This week we take a look at how to properly manage your retirement portfolio with the Bucketing Strategy so that you […]

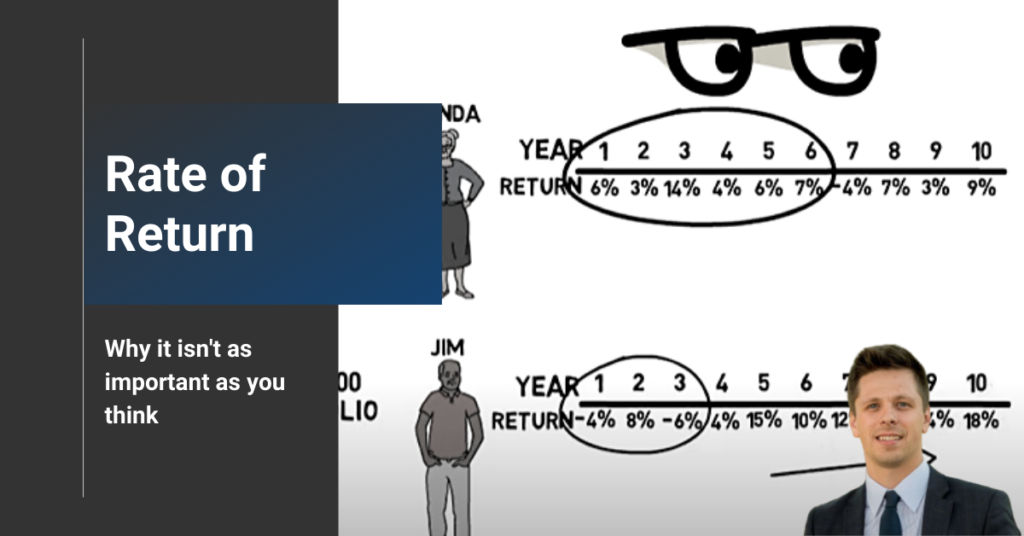

Why your rate of return isn’t as important as you think

[vc_row][vc_column][vc_video link=”https://youtu.be/SDGXOkQjgxE” css=”.vc_custom_1623956167399{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Rate of return vs timing of return Many people believe that the rate of return they earn in their investment portfolio is the number one factor in determining the success of their retirement plan. Although essential, today I want to review why it’s even more important not to […]

How much do I need to save for retirement?

[vc_row][vc_column][vc_column_text]When I first started working in the financial industry over 3,000,000 minutes ago, one of the common rules of thumb was that you needed to save 20% of your income for your retirement. I immediately began to question this advice as it seemed too simple to implement, not to mention an extreme generalization. Imagine if […]

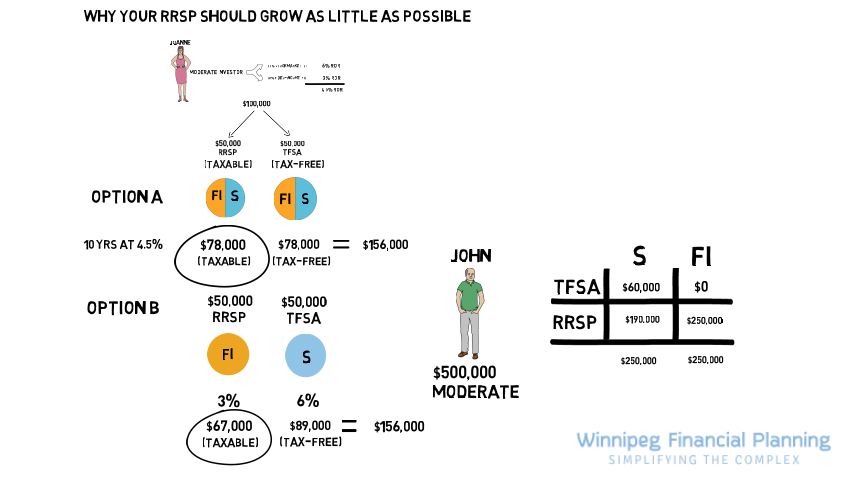

Why your RRSP should grow as little as possible

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=RFAZL6qPwkE&feature=youtu.be Is your portfolio properly structured to minimize tax? Can I keep more money in my pocket without increasing the risk in my portfolio? Find out why your RRSP should grow as little as possible in this week’s video. Enjoy videos? Check out the Video Category for more great strategies. [/vc_column_text][/vc_column][/vc_row]

Pension or Lump Sum? How to Decide

For those of you lucky enough to have a defined benefit pension plan, you may have to decide whether to take your pension as a monthly income or as a lump sum payout upon retiring. There isn’t a universally accepted answer when deciding between these two options, as it mostly depends on your personal circumstances. […]

I Just Sold my Farm, Now What?

You’ve put in years of blood, sweat, and tears into your life’s work and you’re finally able to enjoy the fruits of your labour. You no longer have to worry and stress about grain prices, rain, carbon taxes or whatever other phenomena that affected your crops. You’re now sitting at home, looking at your (presumably […]