I often receive these types of calls after a farm is sold:

- What can I invest in that’s going to give me a reasonable rate of return?

- What can I invest in that is safe?

- What can I invest in that’s going to match the farm rent I was receiving?

There are unlimited options to consider, and the answer always depends on what you are looking to accomplish with your sale proceeds. But to help you get started, I have put together some ideas for you to consider.

I have tried to keep it simple by comparing different investments to the one asset you understand like no other – Farmland.

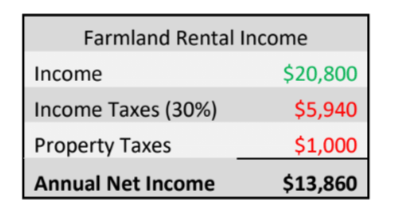

Farmland Rental Income

Let’s first build out a farmland rental scenario that we can compare to different investments.

Assumptions:

- Quarter section valued at $1,000,000 ($6,250/acre)

- Rental income per year is $20,800 ($130/acre)

Now let’s see how this compares to different investments.

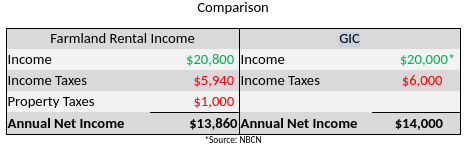

GICs (Guaranteed Income Certificates)

Risk: Very Low

Income: Very Low

Growth Potential: None

Tax Treatment: Poor

Expected Rate of Return: 1% to 2%

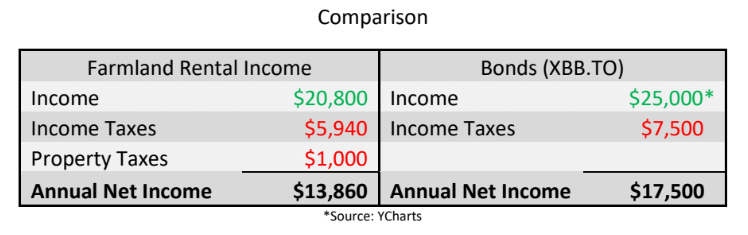

Bonds

Risk: Low

Income: Low

Growth: Low

Tax Treatment: Poor

Expected Rate of Return: 1% to 5%

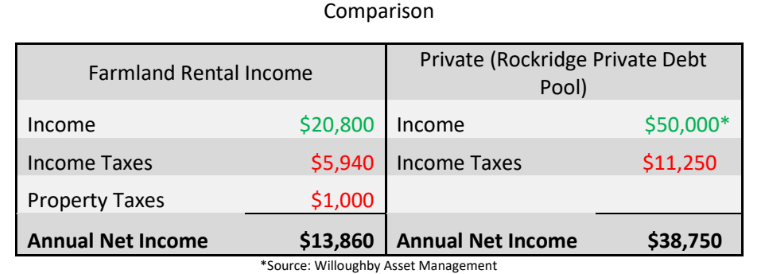

Private Investments

Risk: Low-Medium

Income: Medium

Growth Potential: Low

Tax Treatment: Good

Expected Rate of Return: 4% to 6%

Blue-Chip Dividend Paying Stocks

Risk: Medium

Income: Medium

Growth Potential: Medium

Tax Treatment: Good

Expected Rate of Return: 3% to 5%

Keep in mind, I have not taken into consideration the potential growth of these investments, I am only looking at it from an annual income perspective. For example, even though a GIC would provide you with a higher annual income when compared to farm rental income, I believe farmland is still a better investment because of its potential growth. See my past post – Is Farmland a Good Investment.

Build a Portfolio

Although I have gone over individual options today, just like farming, it makes sense to diversify your crops and not go all-in on one strategy.

A couple of years ago, I put together a short video, showing farmers how to build an investment portfolio and combine some of the pieces I’ve discussed today: Investing after you’ve sold the farm.

As always, if you’d like to chat, I’m only a phone call away: Book Phone Call.