Retiring with a Pension

How does retiring with a pension affect your retirement plans? There are numerous advantages from a tax perspective, and it can also change how much and when you spend your retirement savings. Follow along as we go through the different ways to maximize the flexibility a pension gives you in retirement.

3 Underused Tax Strategies In Retirement

Here are 3 underused tax strategies in retirement, and they involve charitable donations. Before recommending these charitable donation tax strategies to clients, they need to meet certain thresholds. After these two thresholds are met, then we can dive into the three underused tax strategies when giving to charities. The three strategies are withdrawing funds from […]

Steer Clear of These Two Mistakes in Retirement

Typically I don’t talk about investing in our videos but today I want you to steer clear of these two mistakes in retirement. The two mistakes to avoid are poor portfolio construction not aligning your retirement portfolio with your retirement withdrawal strategy.

Retiring at 55 with 2 Million

What does retiring at 55 with 2 million look like? How much will you be able to spend on a monthly basis? Find out as we discuss Heather’s situation.

Tips for Large RRSP Withdrawals

You’ve done a good job saving and have a sizeable nest egg set aside in your RRSPs for retirement, but how do you make tax-efficient RRSP withdrawals? This is the part that most people get wrong and why you hear so many people say they hate RRSPs. Here are tips for withdrawing from a large […]

Tax Mistakes Every Retiree Should Avoid

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/I_3vUWzw4hg” css=”.vc_custom_1706125962708{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1706127224530{padding-top: 20px !important;padding-bottom: 20px !important;}”]There are three tax mistakes that every retiree should avoid. In retirement, there are plenty of tax planning opportunities that can save you a significant amount of money. In meeting with 100s of retirees every year, we see the […]

Managing Your Tax Brackets in Retirement

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/hZniNa0reho” css=”.vc_custom_1699031587886{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699032881455{padding-top: 20px !important;padding-bottom: 20px !important;}”]In the quest to effectively draw down your retirement portfolio, there’s one critical mistake you can’t afford to make—not managing your tax brackets in retirement. As we’ve explored in previous discussions, there’s no universal approach to withdrawing from your […]

Does the CRA Owe You Money?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/pNV3lcxo7NM” css=”.vc_custom_1699030613282{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699030972901{padding-top: 20px !important;padding-bottom: 20px !important;}”]In today’s video, we’re delving into an unusual topic – finding out if the Canada Revenue Agency (CRA) owes you money and exploring key details for retirement planning. Yes, you read that right; the CRA might owe you money! […]

Tax-Efficient Retirement Withdrawal Strategies

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/CZ9luOOhz1c” css=”.vc_custom_1699022153690{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1699024203181{padding-top: 20px !important;padding-bottom: 20px !important;}”]Do you find yourself burdened by high taxes during retirement? Focusing on tax-efficient retirement withdrawal strategies could save you thousands, if not hundreds of thousands of dollars in taxes throughout your retirement. The Retirement Tax Challenge Retirement success […]

RRSP Withdrawals Done Wrong!

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/xdazbDGgZlA” css=”.vc_custom_1695256372526{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695256382030{padding-top: 20px !important;padding-bottom: 20px !important;}”]Many Canadians enter retirement without a serious plan to withdraw their RRSP’s tax efficiently, causing them to pay more tax than they need to. Here are a couple of examples of RRSP Withdrawals Done Wrong![/vc_column_text][/vc_column][/vc_row]

Withdraw From RRSP Tax-Free!

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/cq382duYkg4″ css=”.vc_custom_1695255725576{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1695255865879{padding-top: 20px !important;padding-bottom: 20px !important;}”]Don’t miss out on this RRSP conversation opportunity. See how Crystal missed out on 3 years of tax-free RRSP withdrawals.[/vc_column_text][/vc_column][/vc_row]

Maximizing Your Government Benefits

[vc_row][vc_column][vc_video link=”https://youtu.be/gInDkXCZ8f0″ css=”.vc_custom_1682537628930{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Most Canadians are leaving money on the table when it comes to maximizing their government benefits. In the video above, we review a strategy that individuals and financial advisors often miss. Meet Mike Mike is 65 years old, and his goal in retirement was to be able to […]

Extra RRSP Withdrawal

[vc_row][vc_column][vc_video link=”https://youtu.be/gJWERBrGmAQ” css=”.vc_custom_1673040534150{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]As we approach the end of the year, there are a few tax planning strategies that you should consider before the year is out. Let’s look at if it makes sense to make an extra RRSP withdrawal before the end of the year. Tax Planning Strategy #1: RRSP/RRIF […]

Tax-Loss Selling

[vc_row][vc_column][vc_video link=”https://youtu.be/4VQ7JlpHdDg” css=”.vc_custom_1673039432816{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]What is year-end tax-loss selling, and should you care? When stock markets go through a tough year, the opportunity to take advantage of tax-loss selling arises. So, what exactly is tax-loss selling? Let’s go through an example to find out. Tax-Loss Selling Judy bought $400,000 of ABC Bank shares in […]

Invest Large Lump Sum of Money Tax-Efficiently By Using Your Children

[vc_row][vc_column][vc_video link=”https://youtu.be/sOt9ZbFEuSM” align=”center” css=”.vc_custom_1662486312178{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1662486400157{padding-top: 20px !important;padding-bottom: 20px !important;}”] Here is the scenario You’ve just inherited $1,000,000. You invest the million and it starts generating $40,000/year in dividends. $40,000 is great until you realize the tax man takes away $15,114 every year, leaving you with $24,886. What can you do? Well, you […]

Retirement Plan Leads to $900,000 in Savings

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/LyARyAqkxqw” css=”.vc_custom_1656081943350{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1656083233452{padding-top: 20px !important;padding-bottom: 20px !important;}”]Here is a real-life example of how two tweaks to a couple’s retirement plan, saved them over $900,000. For this video, we start by going over Donna and Steve’s (names have changed for confidentiality reasons) background and going over […]

Where Should I Invest?

[vc_row][vc_column][vc_video link=”https://youtu.be/sv3I9T39enc” css=”.vc_custom_1653491806784{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1653493472178{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today I will be discussing an option that business owners have when they have some cash inside the corporation that they do not need to fund their business. The question is “I have some money. Where should I invest? Inside my corporation, or should […]

Using a Margin Account

[vc_row][vc_column][vc_video link=”https://youtu.be/nZNMGRdvkVM” css=”.vc_custom_1650377283130{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1651074583935{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript Today I’m going to talk about a Margin Account and how it recently helped one of my clients who was in a tough spot. Before we get started, this strategy is not suitable for everyone, please talk to a professional before […]

First Home Savings Account

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/McWO2JT4_7A” css=”.vc_custom_1649865864217{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1649866431381{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript: First Home Savings Account Today we’re going over the brand new Tax-Free First Home Savings Account (FHSA), which was recently introduced in the 2022 Canadian Budget. One of the major initiatives of this year’s budget was […]

Should NHL Players Open a Corporation?

[vc_row][vc_column][vc_video link=”https://youtu.be/VdvTNRxlKl4″ css=”.vc_custom_1644946091219{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1644944455867{padding-top: 20px !important;padding-bottom: 20px !important;}”]Tax Season: Part 5 discusses when should NHL players open a corporation. If you haven’t had a chance to watch Parts 1 to 4, check out the videos below. Tax Season: Part 4 Tax Season: Part 3 Tax Season: Part 2 Tax Season: Part […]

RCA Trust

[vc_row][vc_column][vc_video link=”https://youtu.be/AltdIrXkVFo” css=”.vc_custom_1643648424573{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1643736274093{padding-top: 20px !important;padding-bottom: 20px !important;}”]Tax Season: Part 4 discusses RCA Trusts. An RCA Trust is an option for players playing in Canada to help mitigate some of the higher taxes they will have to pay. RCA stands for retirement compensation agreement. Let’s discuss an overview of: how the […]

Tax Season: Part 3

[vc_row][vc_column][vc_video link=”https://youtu.be/kc7smo4bZ80″ css=”.vc_custom_1643040072497{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]In the Tax Season: Part 3, we take a look at one of the tax planning opportunities available to players. If you haven’t had a chance to watch the first two videos, check out the videos below. Tax Season: Part 2 Tax Season: Part 1 The residency […]

Tax Season: Part 2

[vc_row][vc_column][vc_video link=”https://youtu.be/bbMEJFP5NQg” css=”.vc_custom_1641915791229{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Tax Preparation In Tax Season – Part 2, I dive deeper into what exactly tax preparation is and what you should look for. Whether you’re a do-it-yourself tax filer or hiring someone to do it for you, it can help you understand what questions you should ask and […]

How Is Your Investment Portfolio Taxed?

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text] Don’t throw $440k out the window Has a credit card statement ever made you yell out, Holy Moly!!!!! (or insert expletive)? That’s what happened to me last week, and I quickly found myself on a call with my credit card provider. To my surprise, I was apparently treating someone […]

Avoiding the RRSP Tax Bomb

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text] Avoiding the RRSP Tax Bomb I recently met up with some old friends from high school, and we reminisced about some of the good times we had back in the day. We got to talking about the time I absolutely bombed during a class presentation. It was a total […]

The Farm Transfer Tax Bill

[vc_row][vc_column][vc_column_text css=”.vc_custom_1623123600917{padding-top: 20px !important;padding-bottom: 20px !important;}”] The Farm Transfer Tax Bill C-208 Explained As you may have recently heard, Bill C-208 is proposing to amend the federal income tax act so farm sales to children aren’t taxed at a higher rate when compared to selling the farm to a third party. Many articles explain that […]

How much of their salary do NHL players keep?

[vc_row][vc_column][vc_column_text] How much of their salary do NHL players keep? In my article – how do pro athletes go broke – I highlighted that a leading cause of some high-income earning athletes experiencing financial trouble occurs because they don’t have a firm understanding of how much money they actually make. Just because TSN reports that […]

RRSP Tax Bomb

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/yd1jwxKchYI”][vc_column_text css=”.vc_custom_1639420006496{padding-top: 20px !important;padding-bottom: 20px !important;}”] One of the biggest issues with an RRSP is the tax bomb it can create. We first go over the Canadian tax system to understand why this tax bomb can happen and then a strategy on how to avoid it! How can you […]

A Capital Gains Exemption Quirk

[vc_row][vc_column][vc_video link=”https://youtu.be/CqypqnZB0FA”][vc_column_text css=”.vc_custom_1613672399507{padding-top: 20px !important;padding-bottom: 20px !important;}”]If you’re not a farmer, but you own farmland that qualifies for the capital gain exemption, make sure you don’t pass away before using the exemption![/vc_column_text][/vc_column][/vc_row]

Taxes – A Few Things To Consider

[vc_row][vc_column][vc_column_text] As the saying goes – there are only two certainties in life: death & taxes. Playing professional hockey provides numerous perks in life, however avoiding taxes is not one of them. Undoubtedly, your tax bill as a pro hockey player will be your largest expense and can create a massive discrepancy between what your […]

The Easiest Way to Reduce Your Tax Bill

[vc_row][vc_column][vc_video link=”https://youtu.be/nSpI2-dtGPw” css=”.vc_custom_1633105309436{padding-bottom: 20px !important;}”][vc_column_text] The Easiest Way to Reduce Your Tax Bill Click above to view video! Thank you for watching our video.[/vc_column_text][/vc_column][/vc_row]

Gifting the Farmland

[vc_row][vc_column][vc_video link=”https://youtu.be/BY5NKn3F2Sc” css=”.vc_custom_1630350208840{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Gifting the Farmland In this week’s video we review the different ways you can gift farmland to your children along with the pros and cons of both methods.[/vc_column_text][/vc_column][/vc_row]

Should I Be Buying RRSPs?

[vc_row][vc_column][vc_video link=”https://youtu.be/WCWwAhFa7kY” align=”center” css=”.vc_custom_1612464257262{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Should I Be Buying RRSPs? The answer to that question is going to depend on a few different factors. This latest video can help you understand whether or not investing in RRSPs is the right decision for you. [/vc_column_text][/vc_column][/vc_row]

How Do Pro Athletes Go Broke?

[vc_row][vc_column][vc_column_text] How do pro athletes go broke? “If you’re playing in the NHL, you’ve got a pretty good life” These were the words spoken by Paul Maurice after an NHL player poll slated Winnipeg as “the most dreaded road trip.” As a proud Winnipegger, hearing how our “great” city is actually the worst place to […]

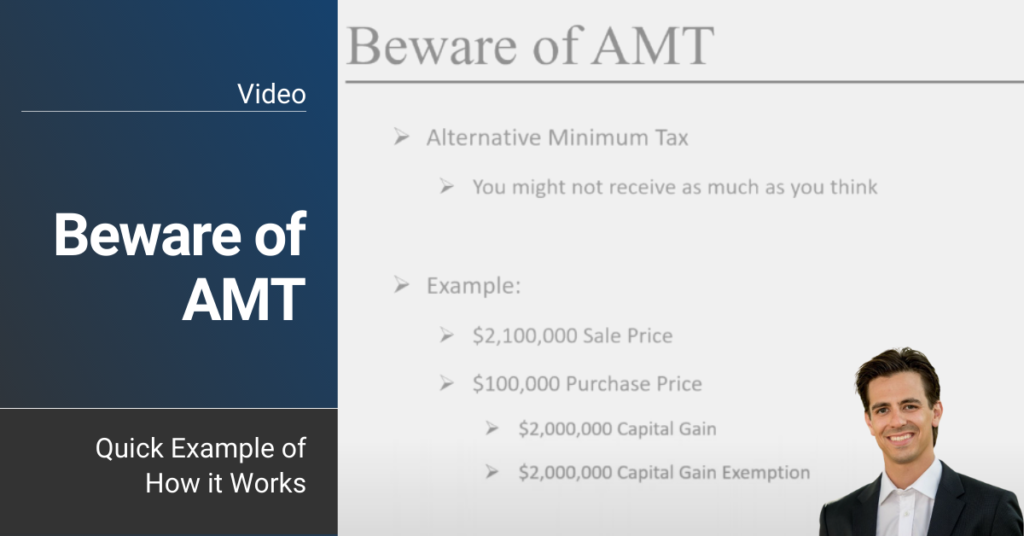

Beware of AMT

[vc_row][vc_column][vc_video link=”https://youtu.be/NOzkZQx7Fjw” css=”.vc_custom_1630350334573{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][vc_column_text css=”.vc_custom_1630350311731{padding-top: 20px !important;padding-bottom: 20px !important;}”] Beware of AMT Here is a quick video on what alternative minimum tax is and how it works. Enjoy![/vc_column_text][/vc_column][/vc_row]

Does Your Spouse Qualify?

[vc_row][vc_column][vc_video link=”https://youtu.be/hQK8bFO2JU8″ css=”.vc_custom_1630350476200{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Does your spouse qualify? This week we interviewed Julien Grenier, accountant, and partner at Talbot & Associates. We discuss what CRA looks at when determining whether your spouse can or can’t use their capital gains exemption on the sale of your farmland. Julien can be reached at julien.grenier@talbotcpa.ca or 204-269-7460[/vc_column_text][/vc_column][/vc_row]

Too Much Cash in Your Corp!

[vc_row][vc_column][vc_video link=”https://youtu.be/exR8blXVnOA” css=”.vc_custom_1630350554688{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Too much cash in your corp See my latest video going over a case study where one farmer thought his farm corporation qualified for the lifetime capital gains exemption but didn’t due to having too much cash.[/vc_column_text][/vc_column][/vc_row]

Tax Planning Strategies: Dealing with Capital Gains (Part 4)

[vc_row][vc_column][vc_column_text] Wanda has been investing for a long time and is quite familiar with buying when prices are low and selling when prices are high. Past non-registered account purchase In 2010, she had purchased $100,000 of ABC Corp, and today, it’s worth $250,000. Wanda is now ready to sell her investment as she believes the […]

Tax Planning Strategies: Tax-Loss Selling (Part 3)

[vc_row][vc_column][vc_column_text] Tax-Loss Selling Judy bought $400,000 of ABC Bank shares in her non-registered account. Today her ABC Bank shares are worth $375,000, and she is showing a $25,000 loss. Judy plans on holding these shares for the next ten years, so she isn’t overly concerned with the short term drop in her investment. For this […]

Let’s Multiply Your Capital Gains Exemption

[vc_row][vc_column][vc_video link=”https://youtu.be/VqzR8GWy8mY” css=”.vc_custom_1630352006724{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Let’s Multiply Your Capital Gains Exemption As a farmer, you have a lifetime exemption of one million dollar on the sale of farmland. If you exceed that amount, you could be looking at a large tax bill. Here is an option to increase your capital gains exemption. In this video, we will show two things. First, when no plan is in place and the ensuing tax bill. Second, […]

Tax Planning Strategies: 4 Strategies You Should Implement this Year (Part 2)

[vc_row][vc_column][vc_column_text] It’s the beginning of December, and Bob has purchased a rental property from his brother. Imagine how unfair it would be if Bob had to pay tax on his brother’s rental income for the entire year. Fortunately for Bob, that’s not the case, but this can happen when you purchase an investment in a […]

Tax Planning Strategies: 4 Strategies You Should Implement this Year (Part 1)

[vc_row][vc_column][vc_column_text]Much like the summer months, December seems to come and go in the blink of an eye. We’re all so busy with work events and family gatherings that year end tax planning often gets neglected. With COVID forcing most of us to stay home this year, we can all use this opportunity to make sure […]

Trusts – How to keep your farmland in the family and save taxes

[vc_row][vc_column][vc_video link=”https://youtu.be/lbl7iwupODM” css=”.vc_custom_1630352063314{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]This quick video on trusts explains how to keep farmland within the family while being as tax-efficient as possible![/vc_column_text][/vc_column][/vc_row]

Managing Your Portfolio in Retirement

[vc_row][vc_column][vc_column_text]https://youtu.be/3mwAUqolv20 Managing Your Portfolio in Retirement The financial industry tends to make things more complex than they need to be. As a result, topics like this usually go in one ear and out the other. My aim with this webinar is to simplify this topic by providing an explanations (in simple English). This webinar will cover topics to be aware of as you approach or […]

The GIS Strategy: How To Receive Tax-Free Income

[vc_row][vc_column][vc_video link=”https://youtu.be/4RmIFXCjoaM” css=”.vc_custom_1615868841483{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]As an Investment Advisor and Certified Financial Planner, I’m relied upon to reduce my client’s tax bill as much as possible. Today, I wanted to share with you a strategy that, if implemented correctly, can see your family receive nearly $140,000 tax-free from the government. That’s a lot of […]

Selling The Farm? Keep an Eye on Your Tax Bracket

[vc_row][vc_column][vc_column_text]In Canada, we have a progressive tax system, which means lower-income earners will pay less tax on a percentage basis compared to higher-income earners. Tax Brackets Explained Here are the combined Manitoba and Federal tax brackets for 2020: Provincial and Federal Tax Rates (Combined) Taxable Income Tax Rate $0 to $33,389 25.80% $33,389-$48,535 27.75% $48,535-$72,164 […]

Understanding the Proposed CSSB Pension Changes

[vc_row][vc_column][vc_column_text css=”.vc_custom_1611896333374{padding-bottom: 20px !important;}”]https://youtu.be/2r5I0HeZNa4?t=2 *It was expected that Bill 43 would receive Royal Assent (Approval) when the Legislature reconvened in the fall. However, since the Throne Speech was moved up to October 7th, the bills that were being discussed during the spring session have been put on pause. Because of this, the status and timing […]

My uncensored opinion about RRSPs if you have a pension

[vc_row][vc_column][vc_column_text css=”.vc_custom_1612815094599{padding-bottom: 20px !important;}”] Psychologists call this phenomenon the “illusionary truth effect.” According to Psychology Today, “When determining whether a given claim is true, we don’t always critically evaluate sources or search for corroborating evidence. Instead, we often intuitively evaluate whether a certain claim feels true. And a claim feels more “true” if it comes […]

How to sell your business tax-free

You started a business from scratch that’s now worth $1.7 million. If you sold today, you’d be able to avoid paying capital gain taxes as both you and your spouse have your $850,000 capital gains exemption room. However, you’re not ready to sell and you’re wondering, “How can I shelter the future gains my business […]

Important considerations to make before accepting an early retirement package

[vc_row][vc_column][vc_column_text]Companies will often offer employees early retirement packages to encourage them to retire. This is usually done when the company is looking to cut costs and reduce staff. Before making a decision, there are many questions to be addressed. All of which are specific to individual preferences and circumstances. Here are eight such considerations to […]

How to convert your health expenses into corporate expenses

[vc_row][vc_column][vc_video link=”https://youtu.be/Oc_FKNvMfLg” css=”.vc_custom_1630360014964{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 2px !important;}”][vc_column_text css=”.vc_custom_1616520171904{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today, I’ll be showing you how to tax-efficiently convert your family’s healthcare costs, into a corporate expense with the use of Private Health Service Plans. The scenario Here’s our scenario. You go to the dentist for your annual checkup, and lo and […]

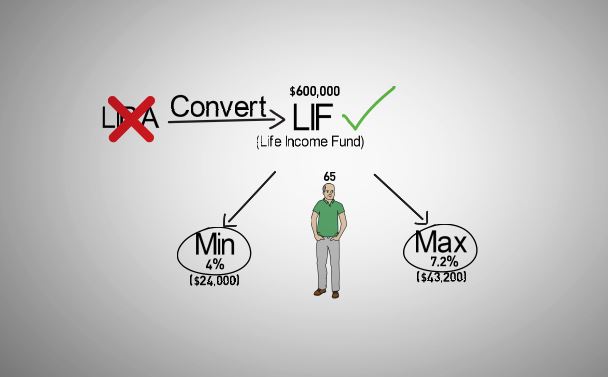

What happens when you withdraw your pension?

[vc_row][vc_column][vc_column_text]https://youtu.be/JcziaDS5R2M Today we’ll be going over what happens when choosing the lump sum payout option from your defined benefit pension plan. As you’re likely aware, a defined benefit pension plan will pay you a monthly income for life, so why choose the lump sum payout option instead? A few common reasons include: Pension […]

How to supercharge your RRSP

[vc_row][vc_column][vc_column_text] Don Jacobs is three years away from retirement and is looking for a way to supercharge his RRSP. With the 2018 RRSP deadline just around the corner, we help Don maximize his contributions so he can achieve his retirement goal in the next three years. Now that Don’s contribution has been […]

Start your succession planning with the basics

Don’t wait until you have all the answers before you start working on a succession plan. As farm advisors, we often get questions like “How much does insurance cost for someone like me? What would the tax consequences be if I transferred land to my children? If I sell my land and invest the proceeds, […]

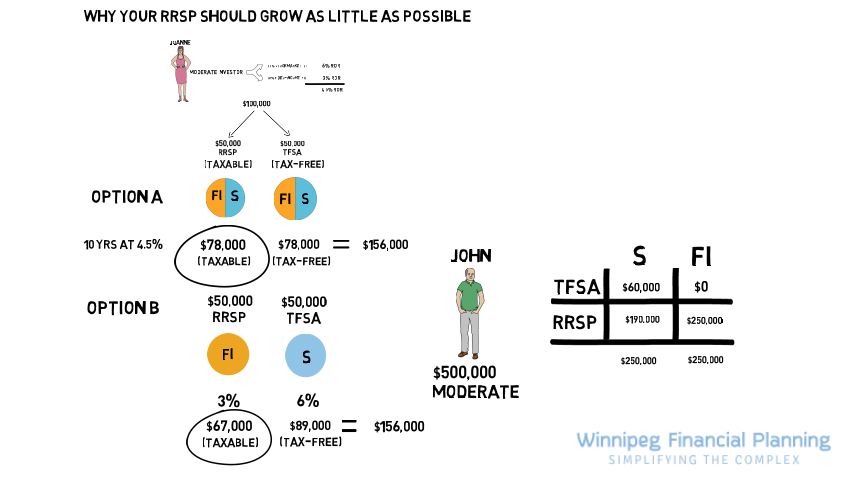

Why your RRSP should grow as little as possible

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=RFAZL6qPwkE&feature=youtu.be Is your portfolio properly structured to minimize tax? Can I keep more money in my pocket without increasing the risk in my portfolio? Find out why your RRSP should grow as little as possible in this week’s video. Enjoy videos? Check out the Video Category for more great strategies. [/vc_column_text][/vc_column][/vc_row]

Can I actually sell my farmland tax-free?

Can I actually sell my farmland tax-free? This week I’ve invited Julien Grenier, Accountant and Agricultural Manager at Talbot & Associates to provide us with insight on qualifying for your capital gains exemptions. As a financial planner, I lean heavily on professionals like Julien to provide my clients with proper tax advice. As you can see […]

Get the most out of your retirement savings

Sometimes withdrawing more is the best strategy. Introducing Daniel Daniel worked hard all his life, so by the time he retired he had accumulated a healthy amount of savings in his RRSP. It’s not because Daniel had an overabundant cashflow. There were years where he had to choose between replacing his TV or contributing to […]

Timing your Retirement to Save Tax $$$

You’ve been targeting the unreduced pension date that you’ve seen on your yearly pension statement for the last twenty years. It’s finally within arm’s reach and you are set on retiring on that exact date. You’ve put in the time and you’re tired of hearing Carl’s nonsense about the Jets around the water cooler. As […]

Life Insurance – Why Millionaires are Buying as Much of it as Possible

If you’re in your sixties, you’ve most likely had a need for life insurance in the past. Whether it was when you purchased your first home and wanted to protect your spouse and children, or when the bank required it as a condition of lending you money. These were situations when life insurance was a […]

Pension or Lump Sum? How to Decide

For those of you lucky enough to have a defined benefit pension plan, you may have to decide whether to take your pension as a monthly income or as a lump sum payout upon retiring. There isn’t a universally accepted answer when deciding between these two options, as it mostly depends on your personal circumstances. […]

I Just Sold my Farm, Now What?

You’ve put in years of blood, sweat, and tears into your life’s work and you’re finally able to enjoy the fruits of your labour. You no longer have to worry and stress about grain prices, rain, carbon taxes or whatever other phenomena that affected your crops. You’re now sitting at home, looking at your (presumably […]