10 Positives Going Into 2023

[vc_row][vc_column][vc_column_text]It’s always nice to hear positive news. So as we head into 2023, here are a few things to look forward to 10 Positives Back-to-back negative stock market years are rare having only occurred 9% of the time since 1928. Although still high, inflation has been decreasing over the past 6 months 2023 […]

Should You Wait Until Things Look Better To Invest?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1665601800315{padding-top: 20px !important;padding-bottom: 20px !important;}”]With the recent decline in stock markets, some of you have called looking to take advantage of this drop and buy low. The one question that comes up in every conversation is: “I know I should buy when stocks are down, but should we wait until things start to […]

The Bear Market Playbook

[vc_row][vc_column][vc_column_text css=”.vc_custom_1655224320509{padding-top: 20px !important;padding-bottom: 20px !important;}”]As we find ourselves in a new bear market, let’s review three different strategies for making the most of this market condition. The Bear Market Playbook bases each strategy on a different risk tolerance level. Option 1: Poke the Bear Rebalance Your Portfolio Rebalancing your portfolio is the process […]

Sell Now And Buy Back Later?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1651241898357{padding-top: 20px !important;padding-bottom: 20px !important;}”] Why don’t we sell and get back in once it’s better? Trust me, I would love to do that for you, but the risk isn’t worth the reward. To begin this analysis, let’s go over your two options Ride the wave Get out and then get back in […]

Our thoughts on the Russian Invasion

[vc_row][vc_column][vc_column_text css=”.vc_custom_1646331106578{padding-top: 20px !important;padding-bottom: 20px !important;}”]The recent Russian invasion has affected us all. From a humanitarian perspective, we hope this war is resolved quickly, and no further loss of innocent life will occur. From a portfolio management perspective, we recognize that these events are reverberating across global markets as investors are trying to assess […]

What should you do?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1645643256609{padding-top: 20px !important;padding-bottom: 20px !important;}”]As the US stock market (S&P 500 index) has officially closed in correction territory (down 10% from its previous high, bear markets are 20% declines), the question is, “What should you do”? To answer this question, we first need to consider – how common are market corrections? How often do […]

Did Your Portfolio Make 21% in ’21?

[vc_row][vc_column][vc_column_text css=”.vc_custom_1643126192582{padding-top: 20px !important;padding-bottom: 20px !important;}”] Did your portfolio make 21% in ‘21? As you begin to receive your 2021 annual reports & statements, one of the questions you should be asking yourself is, “how did I perform in 2021?” Understanding your rate of return is important so up can compare how you stacked up […]

The Farm Transfer Tax Bill

[vc_row][vc_column][vc_column_text css=”.vc_custom_1623123600917{padding-top: 20px !important;padding-bottom: 20px !important;}”] The Farm Transfer Tax Bill C-208 Explained As you may have recently heard, Bill C-208 is proposing to amend the federal income tax act so farm sales to children aren’t taxed at a higher rate when compared to selling the farm to a third party. Many articles explain that […]

Farm Retirement Planning – Option 1: Don’t Sell the Farm

[vc_row][vc_column][vc_column_text]Farmland has been one of the best investments in Canada for the past 25 years.This is clearly shown by an annual growth rate averaging over 5% (as per FCC). If looked at as potential rental income, farmland generates around 7% in annual returns without the wild ride of investing in alternative asset classes. To make […]

US Elections – Should you make moves in your portfolio?

[vc_row][vc_column][vc_column_text]The US election is weeks away and there is no shortage of predictions on how the winner will impact the markets and economy as a whole. Although our natural reaction is to guess how the outcome of the election will impact your wealth, it becomes a futile exercise when we realize how much there is […]

Investment Ideas After You’ve Sold the Farm

I often receive these types of calls after a farm is sold: What can I invest in that’s going to give me a reasonable rate of return? What can I invest in that is safe? What can I invest in that’s going to match the farm rent I was receiving? There are unlimited options to […]

The Market Has Never Taken a Dollar from Anyone

[vc_row][vc_column][vc_column_text] The S&P 500 rises to a record close, fully wiping out its coronavirus losses With the US market hitting a new all-time high yesterday, I wanted to review one of my favorite sayings when it comes to investing: “The Market Has Never Taken a Dollar from Anyone” Whenever I mention this to new investors […]

Selling The Farm? Keep an Eye on Your Tax Bracket

[vc_row][vc_column][vc_column_text]In Canada, we have a progressive tax system, which means lower-income earners will pay less tax on a percentage basis compared to higher-income earners. Tax Brackets Explained Here are the combined Manitoba and Federal tax brackets for 2020: Provincial and Federal Tax Rates (Combined) Taxable Income Tax Rate $0 to $33,389 25.80% $33,389-$48,535 27.75% $48,535-$72,164 […]

Why are markets going up?

Over the past few weeks, I’ve been having this discussion with clients. Why does the market continue to rise while unemployment in the US is sitting at 40 million (the size of Canada’s population), and most businesses aren’t even close to running at 100% capacity? Everyone has their opinions and theories as to what is […]

A Simple Formula to Calculate What Is Fair

Figuring out how much your non-farming children should receive when you pass away compared to your farming child is tough. As I’m sure you’ve heard, fair doesn’t always mean equal when it comes to farm transition planning. To help you get started on coming up with a “fair amount,” here’s a formula you can use. […]

Is Farmland a Good Investment? Part 2

Last week we looked at the cash flow farmland generates (See Part 1). We assumed one acre was worth $6,000 and the rental income was $130/acre. This gave us a rate of return of approximately 2.17% on the rental income. We concluded there were alternative investments with better rates of return (GICs and dividend-paying stocks […]

Is Farmland a Good Investment?

My immediate response would be, who’s asking? An investor or a farmer? Because their goals for the farmland are completely different. Farmers have multiple reasons why farmland would be a good investment beyond simply looking at the rate of return. For this analysis, let’s look at it from the perspective of an investor. This could […]

How to gift wealth to your adult children

I was reading the other day that the current cost of raising a child from birth to 17 is about $325,000. And yet, after all that we still want to gift them our wealth?!?! We must be crazy! But having had a child in the last year, I get it. There’s nothing a parent wouldn’t […]

Investing after you’ve sold the farm

You’ve done your tax and succession planning, you’ve had the big farm auction, and your farm is sold. You’ve given some money to the kids, you’ve paid off your debt, you’ve made a few charitable donations, and you’re left sitting with $2,000,000 in cash. Now you’re left wondering, “Where do I even begin with this […]

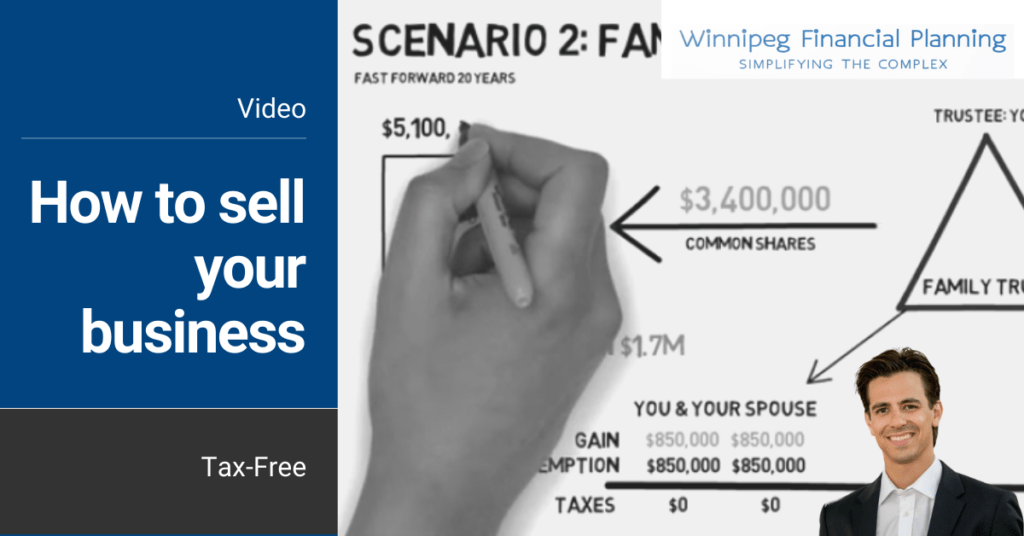

How to sell your business tax-free

You started a business from scratch that’s now worth $1.7 million. If you sold today, you’d be able to avoid paying capital gain taxes as both you and your spouse have your $850,000 capital gains exemption room. However, you’re not ready to sell and you’re wondering, “How can I shelter the future gains my business […]

How to convert your health expenses into corporate expenses

[vc_row][vc_column][vc_video link=”https://youtu.be/Oc_FKNvMfLg” css=”.vc_custom_1630360014964{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 2px !important;}”][vc_column_text css=”.vc_custom_1616520171904{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today, I’ll be showing you how to tax-efficiently convert your family’s healthcare costs, into a corporate expense with the use of Private Health Service Plans. The scenario Here’s our scenario. You go to the dentist for your annual checkup, and lo and […]

Is life insurance an investment or expense?

Are you thinking about purchasing life insurance as a succession planning tool, but having trouble wrapping your head around the annual costs? You might be thinking, “I could be using this cash to buy more land, pay off debt, increase my salary, upgrade my equipment, etc.” I get it, insurance isn’t a very exciting topic, […]

Should I buy life insurance today or tomorrow?

[vc_row][vc_column][vc_column_text] Life insurance is one tool farmers use to help equalize their estate. Below is a comparison of the different costs of buying your life insurance today rather than waiting until you’re older. The scenario You have two children. One would like to farm; the other one isn’t interested. You want to make things […]

Start your succession planning with the basics

Don’t wait until you have all the answers before you start working on a succession plan. As farm advisors, we often get questions like “How much does insurance cost for someone like me? What would the tax consequences be if I transferred land to my children? If I sell my land and invest the proceeds, […]

Can I actually sell my farmland tax-free?

Can I actually sell my farmland tax-free? This week I’ve invited Julien Grenier, Accountant and Agricultural Manager at Talbot & Associates to provide us with insight on qualifying for your capital gains exemptions. As a financial planner, I lean heavily on professionals like Julien to provide my clients with proper tax advice. As you can see […]

Generating retirement income from your farmland

Entering retirement with farmland that you can use to generate rental income is a great way to create a steady income. However, there are a few points to consider to make sure you’re generating enough income and being as tax efficient as possible. Have a plan Unfortunately, land isn’t like a savings account. If you’re […]

Life Insurance – Why Millionaires are Buying as Much of it as Possible

If you’re in your sixties, you’ve most likely had a need for life insurance in the past. Whether it was when you purchased your first home and wanted to protect your spouse and children, or when the bank required it as a condition of lending you money. These were situations when life insurance was a […]

I Just Sold my Farm, Now What?

You’ve put in years of blood, sweat, and tears into your life’s work and you’re finally able to enjoy the fruits of your labour. You no longer have to worry and stress about grain prices, rain, carbon taxes or whatever other phenomena that affected your crops. You’re now sitting at home, looking at your (presumably […]

An Argument for Taking CPP Early

Last month I wrote and article arguing why it makes sense to take CPP later. This month we will review the argument for taking it early. As I mentioned last time, everyone seems to have an opinion on the matter but few people realize that this isn’t a “one size fits all” problem. If you […]

An Argument for Taking CPP Later

In this 2-part series, we will explore both sides of the age-old question “should I take CPP (Canada Pension Plan) earlier or later?” We’ve all met purported CPP experts at some point in our lives. It may have been a member of your family, your plumber, or your dentist. The fact is that everybody has […]