Retirement Plan Leads to $900,000 in Savings

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_video link=”https://youtu.be/LyARyAqkxqw” css=”.vc_custom_1656081943350{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1656083233452{padding-top: 20px !important;padding-bottom: 20px !important;}”]Here is a real-life example of how two tweaks to a couple’s retirement plan, saved them over $900,000. For this video, we start by going over Donna and Steve’s (names have changed for confidentiality reasons) background and going over […]

Private Home Care

[vc_row css=”.vc_custom_1612380408194{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column][vc_column_text]According to a recent survey[1] from CARP (Canadian Association of Retired Persons), nearly 95% of seniors want to stay in their homes as they age. This isn’t overly surprising considering the negative connotation associated with care homes. We all have that relative who we’ve heard say I’d rather ….. than […]

Retirement: What You Need to Know

[vc_row][vc_column][vc_column_text]https://youtu.be/6UwIGk_WKoU You’ve worked hard for decades, and now that you are approaching or entering retirement, you could find yourself exposed to significant taxes without the proper strategies in place. Keep more of what you’ve built and enjoy the retirement you deserve. This complimentary video will cover the following topics: Am I on […]

A Simple Formula to Calculate What Is Fair

Figuring out how much your non-farming children should receive when you pass away compared to your farming child is tough. As I’m sure you’ve heard, fair doesn’t always mean equal when it comes to farm transition planning. To help you get started on coming up with a “fair amount,” here’s a formula you can use. […]

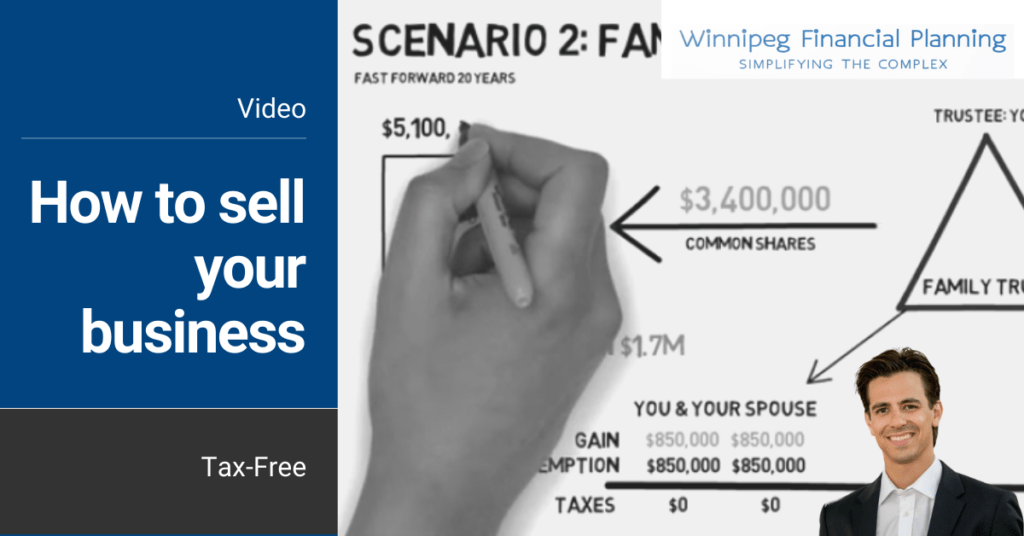

How to sell your business tax-free

You started a business from scratch that’s now worth $1.7 million. If you sold today, you’d be able to avoid paying capital gain taxes as both you and your spouse have your $850,000 capital gains exemption room. However, you’re not ready to sell and you’re wondering, “How can I shelter the future gains my business […]

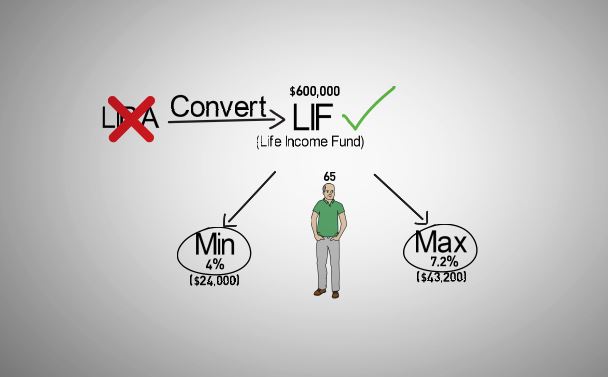

What happens when you withdraw your pension?

[vc_row][vc_column][vc_column_text]https://youtu.be/JcziaDS5R2M Today we’ll be going over what happens when choosing the lump sum payout option from your defined benefit pension plan. As you’re likely aware, a defined benefit pension plan will pay you a monthly income for life, so why choose the lump sum payout option instead? A few common reasons include: Pension […]

Should I buy life insurance today or tomorrow?

[vc_row][vc_column][vc_column_text] Life insurance is one tool farmers use to help equalize their estate. Below is a comparison of the different costs of buying your life insurance today rather than waiting until you’re older. The scenario You have two children. One would like to farm; the other one isn’t interested. You want to make things […]

Can I actually sell my farmland tax-free?

Can I actually sell my farmland tax-free? This week I’ve invited Julien Grenier, Accountant and Agricultural Manager at Talbot & Associates to provide us with insight on qualifying for your capital gains exemptions. As a financial planner, I lean heavily on professionals like Julien to provide my clients with proper tax advice. As you can see […]

Get the most out of your retirement savings

Sometimes withdrawing more is the best strategy. Introducing Daniel Daniel worked hard all his life, so by the time he retired he had accumulated a healthy amount of savings in his RRSP. It’s not because Daniel had an overabundant cashflow. There were years where he had to choose between replacing his TV or contributing to […]

Pension or Lump Sum? How to Decide

For those of you lucky enough to have a defined benefit pension plan, you may have to decide whether to take your pension as a monthly income or as a lump sum payout upon retiring. There isn’t a universally accepted answer when deciding between these two options, as it mostly depends on your personal circumstances. […]

Passing Down the Family Cottage

Cottages often hold a lot of sentimental value to families and are home to a lot of great memories. Many cottage owners would like to see their children and grandchildren get the same joy from the property that they did, even after they are gone. It may seem like a nice sentiment but leaving the […]