The NHL Pension

[vc_row][vc_column][vc_column_text] The NHL Pension – What you need to know If you play in the NHL, you’ll be enrolled in the league’s pension plan, as outlined in the Collective Bargaining Agreement (CBA). Unless you’ve had several cups of coffee and enjoy reading legal jargon, the CBA can be a pretty tough read. So, here’s a […]

The GIS Strategy: How To Receive Tax-Free Income

[vc_row][vc_column][vc_video link=”https://youtu.be/4RmIFXCjoaM” css=”.vc_custom_1615868841483{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]As an Investment Advisor and Certified Financial Planner, I’m relied upon to reduce my client’s tax bill as much as possible. Today, I wanted to share with you a strategy that, if implemented correctly, can see your family receive nearly $140,000 tax-free from the government. That’s a lot of […]

Getting The Best Of Both Worlds From Your Pension

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=lqV8Ehobmkc Wouldn’t it be great to have the benefits of commuting your pension as well as the benefits of a monthly pension? In this brief video, I go over how you can have the best of both worlds. As always, if you’d like to discuss your personal situation and explore your financial options, feel free […]

How Commuting Your Pension Allows You To Manipulate Your Income

[vc_row][vc_column][vc_column_text]https://www.youtube.com/watch?v=TrjWlPOqz2w&feature=youtu.be Deciding between commuting your pension or opting for the monthly income stream is a big retirement decision that contains several complexities. In this brief 3-minute video I provide clarity on the benefits of taking the commuted value compared to the monthly income stream. If you’d like to discuss your personal situation and explore your […]

Significant changes being proposed to the CSSB pension

[vc_row][vc_column][vc_column_text css=”.vc_custom_1615397984394{padding-bottom: 20px !important;}”]*Bill 43 received Royal Assent (Approval) when the Legislature reconvened in October 2020. If you have a CSSB pension, there could be significant changes coming that will affect how the commuted value of your pension is calculated. As I’ve mentioned in the past (Pension or Lump Sum, How to Decide), you […]

Financial Advice for Manitoba Hydro Employees

[vc_row][vc_column][vc_video link=”https://youtu.be/6lPhNQyQ1Zk” css=”.vc_custom_1615869473595{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1611901511867{padding-bottom: 20px !important;}”]I’ve had the pleasure of working with several clients who work or have retired from Manitoba Hydro. While each person’s financial situation is different, some commonalities exist amongst those sharing and employer. This guide identifies those shared characteristics and provides advice regarding their financial planning implications. […]

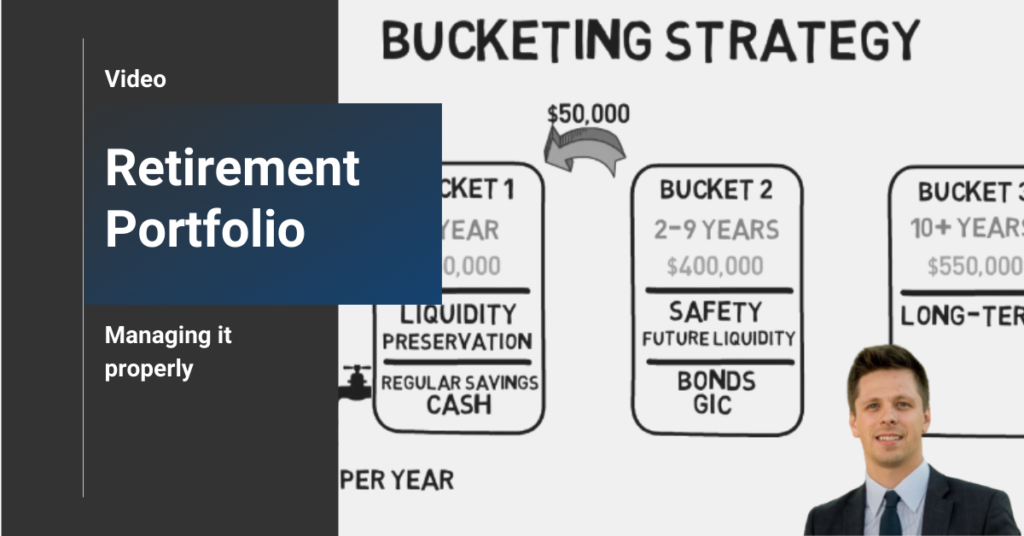

How to properly manage a retirement portfolio

[vc_row][vc_column][vc_column_text]https://youtu.be/q9N2DAt0Djk Are you tired of turning on the nightly news and worrying about how the day’s events are affecting your retirement portfolio? Are you worried about the day-to-day fluctuations of the stock market? This week we take a look at how to properly manage your retirement portfolio with the Bucketing Strategy so that you […]

Important considerations to make before accepting an early retirement package

[vc_row][vc_column][vc_column_text]Companies will often offer employees early retirement packages to encourage them to retire. This is usually done when the company is looking to cut costs and reduce staff. Before making a decision, there are many questions to be addressed. All of which are specific to individual preferences and circumstances. Here are eight such considerations to […]

5 Reasons you should keep your monthly pension

[vc_row][vc_column][vc_column_text]Over the last couple of months, we’ve taken a look at some of the reasons you should withdraw the commuted value from your defined benefit pension plan. (See: Five reasons you should take your pension as a lump sum payout and What happens when you withdraw your pension?) The best strategy always depends on personal circumstances, […]

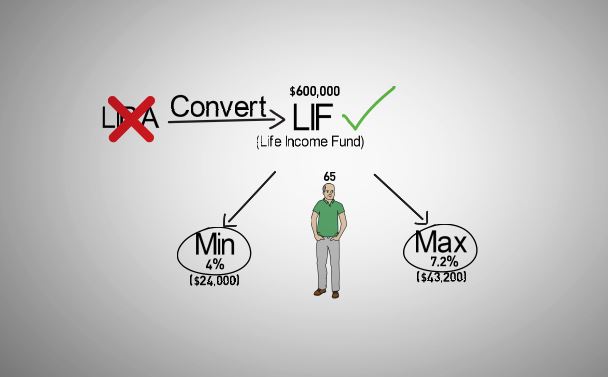

What happens when you withdraw your pension?

[vc_row][vc_column][vc_column_text]https://youtu.be/JcziaDS5R2M Today we’ll be going over what happens when choosing the lump sum payout option from your defined benefit pension plan. As you’re likely aware, a defined benefit pension plan will pay you a monthly income for life, so why choose the lump sum payout option instead? A few common reasons include: Pension […]

Five reasons you should take your pension as a lump sum payout

[vc_row][vc_column][vc_column_text] If you’re planning to leave your employer due to your retirement or a change in career paths, then you may be faced with the decision to either take your pension as a lump sum or as a monthly income. What is a defined benefit plan? A defined benefit plan promises to pay a pre-determined […]

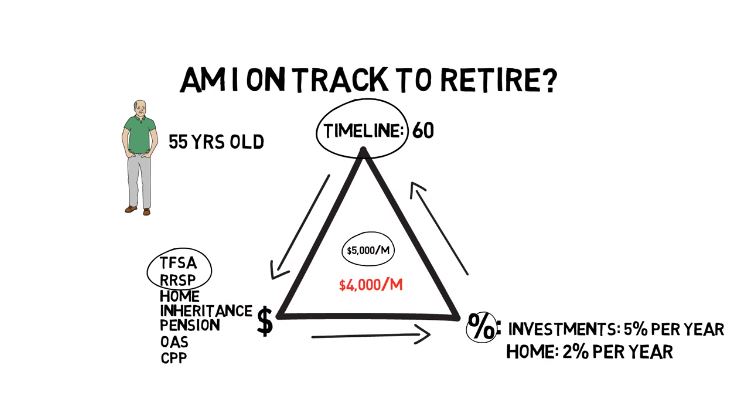

Am I on Track to Retire? – Video

Am I on track to retire? This is a very common question I receive, so today I wanted to give you a simple way that you can get an answer to this question without pulling your hair out. Bob is 55 years old and approaching retirement. He plans on spending his winters in Phoenix and […]

Timing your Retirement to Save Tax $$$

You’ve been targeting the unreduced pension date that you’ve seen on your yearly pension statement for the last twenty years. It’s finally within arm’s reach and you are set on retiring on that exact date. You’ve put in the time and you’re tired of hearing Carl’s nonsense about the Jets around the water cooler. As […]

Pension or Lump Sum? How to Decide

For those of you lucky enough to have a defined benefit pension plan, you may have to decide whether to take your pension as a monthly income or as a lump sum payout upon retiring. There isn’t a universally accepted answer when deciding between these two options, as it mostly depends on your personal circumstances. […]