How to Use Bill C-208 to Transfer Farm Assets Tax-Free

Bill C208 has introduced new flexibility for Canadian family business owners, especially those in agriculture. One powerful result is the ability to use a parent’s capital gains exemption while they are still alive, while also withdrawing cash from a corporation in a tax-efficient way. Let’s walk through a simplified example to show how this works […]

Unlock Big Tax Savings When Selling Your Business to Family

When it comes time to sell your business or family farm, the structure of the sale can have a major impact on your taxes. A recent change in Canadian tax law, known as Bill C-208, has opened new doors for family business owners looking to transfer ownership to the next generation. Here’s what you need […]

How to Trigger Investment Losses in a Corporation the Right Way

Many business owners and incorporated professionals use tax loss harvesting to manage their capital gains. However, when triggering losses in a corporate investment account, there is an important step you do not want to miss. Failing to check your Capital Dividend Account (CDA) balance first could cost you the ability to withdraw money from your […]

How to Transfer Your Business to Your Children

An estate freeze is often recommended as an effective strategy for transitioning your business to the next generation. It offers tax efficiency and allows the business owner to maintain control. Let us walk through how an estate freeze works and what to consider before moving forward. Prefer to watch the video? What Is an Estate […]

2 Things That Should Be In Your Corporation

If you’re a business owner, chances are you’re already thinking about tax efficiency. But there are two common items that many entrepreneurs still hold personally, when it may make far more sense to own them corporately. In this post, we’ll cover how shifting personal debt and life insurance into your corporation can lead to significant […]

Capital Gains Exemption for Business Owners

Today I want to talk about a rule that catches many Canadian business owners off guard: how having too much cash inside your corporation can prevent you from using the Lifetime Capital Gains Exemption (LCGE) when you sell your business. Prefer to Watch the Video? The Value of the Capital Gains Exemption As of 2022, […]

Investment Questions Part 2

[vc_row][vc_column][vc_column_text]Your Investment Questions Answered Part 2. 2022 is off to a rocky start. What is happening? If you focus on short-term swings in financial markets, you will probably ride the emotional rollercoaster, which will make it difficult to make sound, objective investment decisions. We have certainly seen this going back to Q4 2018, when […]

MTAR Accounts for Business Owners

[vc_row][vc_column][vc_video link=”https://youtu.be/7VFfoPw_7gI” css=”.vc_custom_1642018123963{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1642089451799{padding-top: 20px !important;padding-bottom: 20px !important;}”]Are you taking advantage of your corporations to their full capacity? Here is one strategy that may be suitable for your situation. We will use John, a 45-year-old non-smoker for a quick case study. John has $100,000 to invest in his corporation. That investment […]

Investment Questions Part 1

[vc_row][vc_column][vc_column_text] Question 1: We’ve had a very good run in stocks. How will we know when the current market is getting long in the tooth and when it is time to get out and go to cash? It is natural for investors to worry about market declines as there have been some very large ones […]

How To Help Your Employees Retire

[vc_row][vc_column][vc_video link=”https://youtu.be/cqcilDr5Ejs” css=”.vc_custom_1635275350051{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1635274685010{padding-top: 20px !important;padding-bottom: 20px !important;}”] How To Help Your Employees Retire The most tax-efficient way to help your employees to retire is through a DPSP account. Find out how using a DPSP account benefits both the employer and the employee, compared to giving out a bonus.[/vc_column_text][/vc_column][/vc_row]

Farmers and RRSPs

[vc_row][vc_column][vc_video link=”https://youtu.be/3jWpwJTQZZI”][vc_column_text css=”.vc_custom_1615307723455{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this week’s video, we go over how to properly use RRSPs as a farmer.[/vc_column_text][/vc_column][/vc_row]

A Capital Gains Exemption Quirk

[vc_row][vc_column][vc_video link=”https://youtu.be/CqypqnZB0FA”][vc_column_text css=”.vc_custom_1613672399507{padding-top: 20px !important;padding-bottom: 20px !important;}”]If you’re not a farmer, but you own farmland that qualifies for the capital gain exemption, make sure you don’t pass away before using the exemption![/vc_column_text][/vc_column][/vc_row]

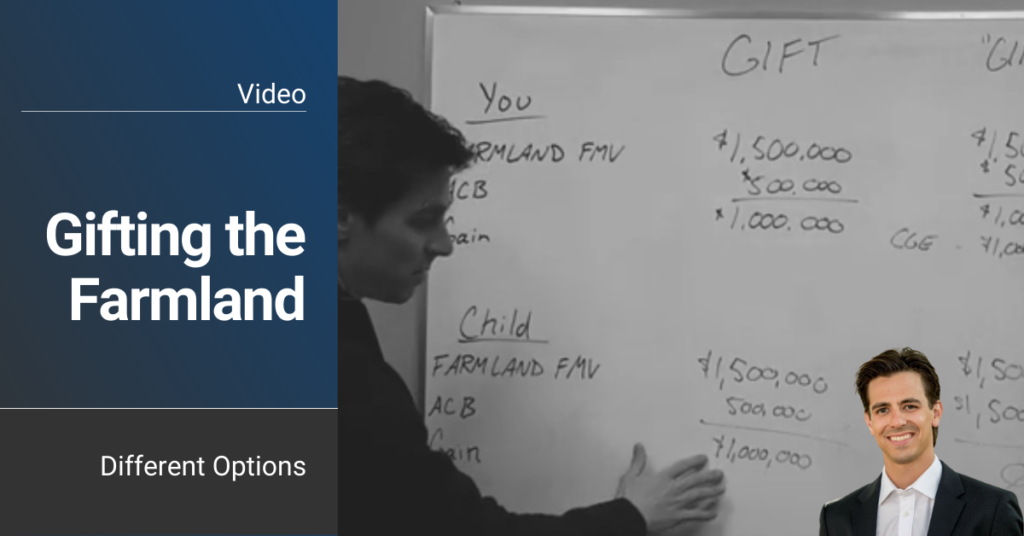

Gifting the Farmland

[vc_row][vc_column][vc_video link=”https://youtu.be/BY5NKn3F2Sc” css=”.vc_custom_1630350208840{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Gifting the Farmland In this week’s video we review the different ways you can gift farmland to your children along with the pros and cons of both methods.[/vc_column_text][/vc_column][/vc_row]

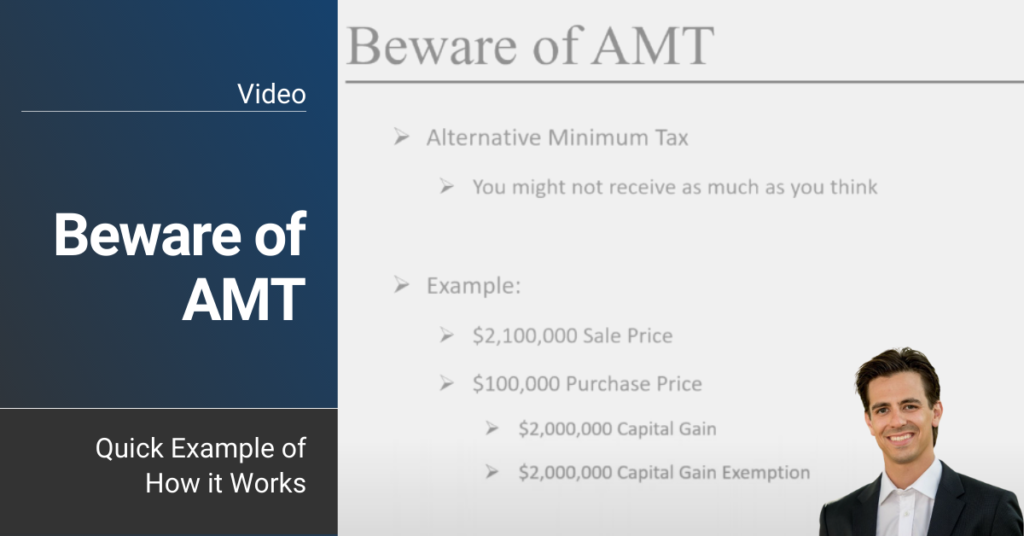

Beware of AMT

[vc_row][vc_column][vc_video link=”https://youtu.be/NOzkZQx7Fjw” css=”.vc_custom_1630350334573{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][vc_column_text css=”.vc_custom_1630350311731{padding-top: 20px !important;padding-bottom: 20px !important;}”] Beware of AMT Here is a quick video on what alternative minimum tax is and how it works. Enjoy![/vc_column_text][/vc_column][/vc_row]

Too Much Cash in Your Corp!

[vc_row][vc_column][vc_video link=”https://youtu.be/exR8blXVnOA” css=”.vc_custom_1630350554688{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Too much cash in your corp See my latest video going over a case study where one farmer thought his farm corporation qualified for the lifetime capital gains exemption but didn’t due to having too much cash.[/vc_column_text][/vc_column][/vc_row]

Let’s Multiply Your Capital Gains Exemption

[vc_row][vc_column][vc_video link=”https://youtu.be/VqzR8GWy8mY” css=”.vc_custom_1630352006724{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Let’s Multiply Your Capital Gains Exemption As a farmer, you have a lifetime exemption of one million dollar on the sale of farmland. If you exceed that amount, you could be looking at a large tax bill. Here is an option to increase your capital gains exemption. In this video, we will show two things. First, when no plan is in place and the ensuing tax bill. Second, […]

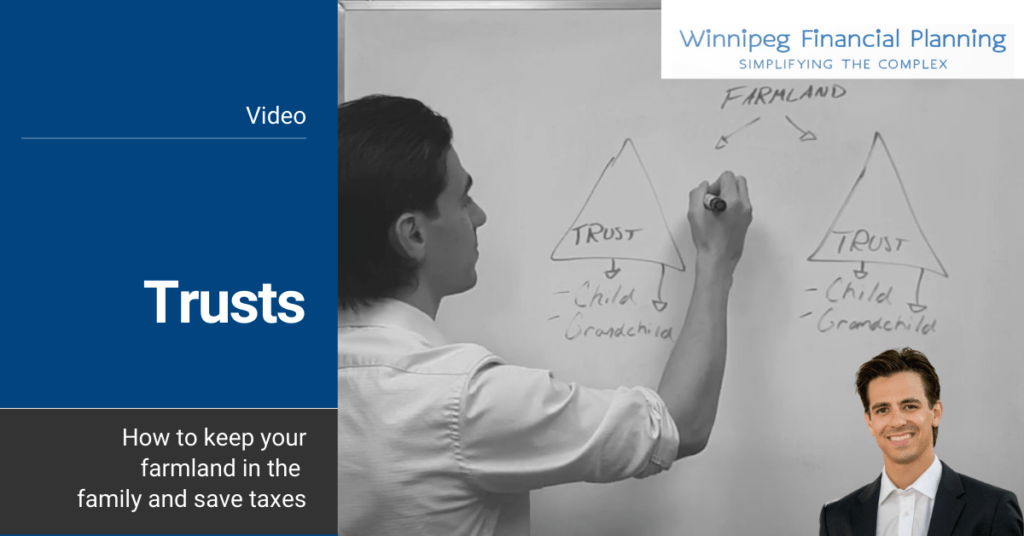

Trusts – How to keep your farmland in the family and save taxes

[vc_row][vc_column][vc_video link=”https://youtu.be/lbl7iwupODM” css=”.vc_custom_1630352063314{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]This quick video on trusts explains how to keep farmland within the family while being as tax-efficient as possible![/vc_column_text][/vc_column][/vc_row]

Farm Retirement Planning – Option 1: Don’t Sell the Farm

[vc_row][vc_column][vc_column_text]Farmland has been one of the best investments in Canada for the past 25 years.This is clearly shown by an annual growth rate averaging over 5% (as per FCC). If looked at as potential rental income, farmland generates around 7% in annual returns without the wild ride of investing in alternative asset classes. To make […]

US Elections – Should you make moves in your portfolio?

[vc_row][vc_column][vc_column_text]The US election is weeks away and there is no shortage of predictions on how the winner will impact the markets and economy as a whole. Although our natural reaction is to guess how the outcome of the election will impact your wealth, it becomes a futile exercise when we realize how much there is […]

Private Health Care Spending Accounts: How Can They Help Your Business?

[vc_row][vc_column][vc_video link=”https://youtu.be/yU88uL6JvAQ” css=”.vc_custom_1630352425942{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]An Educational Webinar presented by Colin Sabourin CFP, CIM, CAFA, and Pierre Normandeau CPA, CGA, IMPORTANT: This webinar is for business owners who are incorporated. In the presentation, Colin and Pierre go step by step through: ➡️How Private Health Care Spending Accounts work ➡️What qualifies as a medical expense […]

A Simple Formula to Calculate What Is Fair

Figuring out how much your non-farming children should receive when you pass away compared to your farming child is tough. As I’m sure you’ve heard, fair doesn’t always mean equal when it comes to farm transition planning. To help you get started on coming up with a “fair amount,” here’s a formula you can use. […]

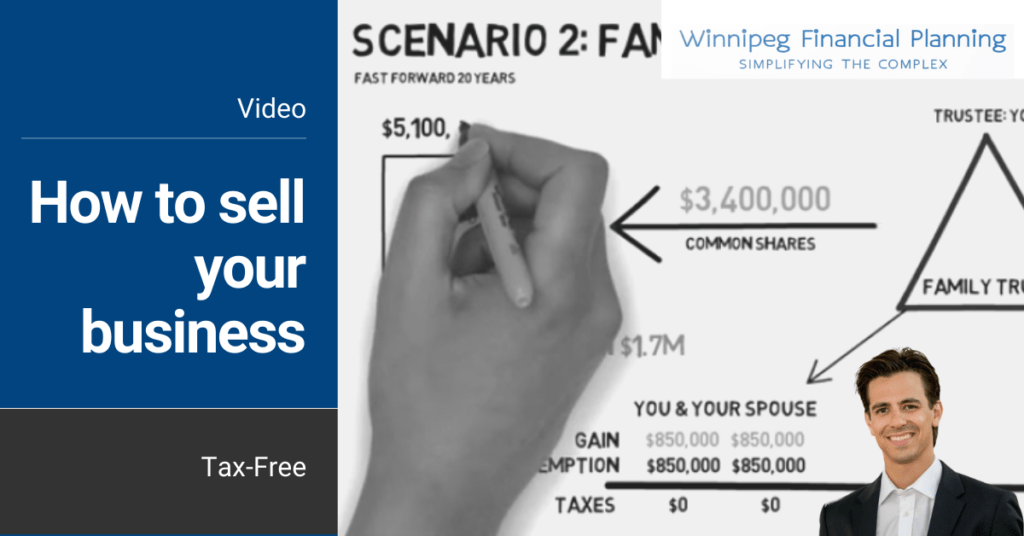

How to sell your business tax-free

You started a business from scratch that’s now worth $1.7 million. If you sold today, you’d be able to avoid paying capital gain taxes as both you and your spouse have your $850,000 capital gains exemption room. However, you’re not ready to sell and you’re wondering, “How can I shelter the future gains my business […]

How to convert your health expenses into corporate expenses

[vc_row][vc_column][vc_video link=”https://youtu.be/Oc_FKNvMfLg” css=”.vc_custom_1630360014964{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 2px !important;}”][vc_column_text css=”.vc_custom_1616520171904{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today, I’ll be showing you how to tax-efficiently convert your family’s healthcare costs, into a corporate expense with the use of Private Health Service Plans. The scenario Here’s our scenario. You go to the dentist for your annual checkup, and lo and […]

Can I actually sell my farmland tax-free?

Can I actually sell my farmland tax-free? This week I’ve invited Julien Grenier, Accountant and Agricultural Manager at Talbot & Associates to provide us with insight on qualifying for your capital gains exemptions. As a financial planner, I lean heavily on professionals like Julien to provide my clients with proper tax advice. As you can see […]

Life Insurance – Why Millionaires are Buying as Much of it as Possible

If you’re in your sixties, you’ve most likely had a need for life insurance in the past. Whether it was when you purchased your first home and wanted to protect your spouse and children, or when the bank required it as a condition of lending you money. These were situations when life insurance was a […]

I Just Sold my Farm, Now What?

You’ve put in years of blood, sweat, and tears into your life’s work and you’re finally able to enjoy the fruits of your labour. You no longer have to worry and stress about grain prices, rain, carbon taxes or whatever other phenomena that affected your crops. You’re now sitting at home, looking at your (presumably […]