How to Use Your Children’s Capital Gains Exemption to Move Millions Tax-Free

If you own a successful farm corporation and have adult children you trust, there is a unique strategy that allows you to move farmland into your company and access millions of dollars tax efficiently. It all comes down to using your children’s lifetime capital gains exemptions. Prefer to watch the video? What You Need To […]

How to Use Bill C-208 to Transfer Farm Assets Tax-Free

Bill C208 has introduced new flexibility for Canadian family business owners, especially those in agriculture. One powerful result is the ability to use a parent’s capital gains exemption while they are still alive, while also withdrawing cash from a corporation in a tax-efficient way. Let’s walk through a simplified example to show how this works […]

Unlock Big Tax Savings When Selling Your Business to Family

When it comes time to sell your business or family farm, the structure of the sale can have a major impact on your taxes. A recent change in Canadian tax law, known as Bill C-208, has opened new doors for family business owners looking to transfer ownership to the next generation. Here’s what you need […]

How to Trigger Investment Losses in a Corporation the Right Way

Many business owners and incorporated professionals use tax loss harvesting to manage their capital gains. However, when triggering losses in a corporate investment account, there is an important step you do not want to miss. Failing to check your Capital Dividend Account (CDA) balance first could cost you the ability to withdraw money from your […]

How to Transfer Your Business to Your Children

An estate freeze is often recommended as an effective strategy for transitioning your business to the next generation. It offers tax efficiency and allows the business owner to maintain control. Let us walk through how an estate freeze works and what to consider before moving forward. Prefer to watch the video? What Is an Estate […]

Invest Large Lump Sum of Money Tax-Efficiently By Using Your Children

If you’ve recently come into a large sum of money and you’re in a high tax bracket, taxes can take a serious bite out of your investment income. But there’s a little-known strategy that can reduce your tax bill, with the help of your children. In this post, we’ll walk through a family trust strategy […]

2 Things That Should Be In Your Corporation

If you’re a business owner, chances are you’re already thinking about tax efficiency. But there are two common items that many entrepreneurs still hold personally, when it may make far more sense to own them corporately. In this post, we’ll cover how shifting personal debt and life insurance into your corporation can lead to significant […]

Capital Gains Exemption for Business Owners

Today I want to talk about a rule that catches many Canadian business owners off guard: how having too much cash inside your corporation can prevent you from using the Lifetime Capital Gains Exemption (LCGE) when you sell your business. Prefer to Watch the Video? The Value of the Capital Gains Exemption As of 2022, […]

Getting Ready for a Bear Market

[vc_row][vc_column][vc_video link=”https://youtu.be/Pmr4cslrJFI” css=”.vc_custom_1652372880628{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1652373623421{padding-top: 20px !important;padding-bottom: 20px !important;}”] Where are we today? When it comes to the markets, as of today May 10th, 2022, the market is down 15% from its high back on January 3rd of 2022. We are trending downwards so I want to talk to you about what […]

Using a Margin Account

[vc_row][vc_column][vc_video link=”https://youtu.be/nZNMGRdvkVM” css=”.vc_custom_1650377283130{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1651074583935{padding-top: 20px !important;padding-bottom: 20px !important;}”] Video Transcript Today I’m going to talk about a Margin Account and how it recently helped one of my clients who was in a tough spot. Before we get started, this strategy is not suitable for everyone, please talk to a professional before […]

AgriInvest

[vc_row][vc_column][vc_video link=”https://youtu.be/nm7u0FkgFlY” css=”.vc_custom_1646755023570{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1646760679141{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today I want to talk to you about AgriInvest and why you should be withdrawing it. Leaving it in your AgriInvest Account When you put money in AgriInvest, let us say $5,000 in this scenario. The government will match your $5,000, for a […]

Make $146,000 Tax-Free in Retirement

[vc_row][vc_column][vc_video link=”https://youtu.be/iH8dSI4FPzU” css=”.vc_custom_1644860757290{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1644959421246{padding-top: 20px !important;padding-bottom: 20px !important;}”]Today we’re looking at a strategy that can earn you $146,000 tax-free in retirement. Reduce your income to zero In our scenario, we have a 65-year-old, who has a spouse, and both are receiving O.A.S. You would be receiving $642 per month. If […]

Donation Strategies for Farmers

[vc_row][vc_column][vc_video link=”https://youtu.be/zWA0wKorp3k” css=”.vc_custom_1640709640403{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1640709664781{padding-top: 20px !important;padding-bottom: 20px !important;}”]Here are some advanced tax planning strategies when it comes to donations. We discuss how you can donate your farm corporate shares and investments to save taxes and support your favourite causes.[/vc_column_text][/vc_column][/vc_row]

Capital Dividend Account

[vc_row][vc_column][vc_video link=”https://youtu.be/O3aKQ0iIM4Q” css=”.vc_custom_1637607466173{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1637608382130{padding-top: 20px !important;padding-bottom: 20px !important;}”] What is it? A capital dividend account is a notional account that increases or decreases when you create capital gains or losses. You aren’t going to see a capital dividend account on any of your bank records or investment records. Before watching this […]

When to Incorporate

[vc_row][vc_column][vc_video link=”https://youtu.be/VoKHTHv4HU8″ css=”.vc_custom_1634577945807{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1634578166776{padding-top: 20px !important;padding-bottom: 20px !important;}”]When does it make sense to incorporate? Farmers, of all ages, are asking this question more and more as farm revenue steadily increases with rising commodity prices. But when is the right time? In this video, Colin compares the differences between being incorporating versus […]

Why Inflation is Killing Your Investment Returns

[vc_row][vc_column][vc_video link=”https://youtu.be/exToZCcxybc” css=”.vc_custom_1632161361839{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1632161933042{padding-top: 20px !important;padding-bottom: 20px !important;}”]Inflation is continuing to be a hot topic these days, hitting 4.1% in Canada. In this video, Colin goes through an example showing how inflation is reducing your buying power, and what can you do with your portfolio to counteract inflation. To read more […]

What is fair?

[vc_row][vc_column][vc_video link=”https://youtu.be/hYt3-AKvefQ” css=”.vc_custom_1631030121078{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1631030201283{padding-top: 20px !important;padding-bottom: 20px !important;}”] In this video, Colin reviews the 2 extremes when it comes to taking care of your non-farming children. Option 1, leave the farm to your farm child, and whatever is left to your non-farming children. Option 2, split everything up evenly. The solutions […]

Don’t Lose Your O.A.S When Selling

[vc_row][vc_column][vc_video link=”https://youtu.be/DiEBoSqCAvE” css=”.vc_custom_1630363492987{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1648655591004{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this video, I go over what Old Age Security is when the clawback starts, and a scenario where you sell your farm and the clawback will likely occur.[/vc_column_text][/vc_column][/vc_row]

Cancel Your Loan Insurance?

[vc_row][vc_column][vc_video link=”https://youtu.be/gugJq5eMFag” css=”.vc_custom_1621352907103{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1621352930446{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this weeks video I go over creditor insurance and how it can be replaced with more cost-effective personal insurance.[/vc_column_text][dt_fancy_image image_id=”5919″ width=”700″ css=”.vc_custom_1621353575577{padding-top: 20px !important;padding-bottom: 20px !important;}”][/vc_column][/vc_row]

Farm Corporations & RRSPs

[vc_row][vc_column][vc_video link=”https://youtu.be/E13JbAW0gvw” css=”.vc_custom_1617129005089{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text css=”.vc_custom_1616981501445{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this week’s video we review at what income levels it makes sense to make RRSP contributions if you’re incorporated. CLICK HERE for my previous RRSP video: Farmers & RRSPs [/vc_column_text][/vc_column][/vc_row]

Starting Your Farm Transition

[vc_row][vc_column][vc_video link=”https://youtu.be/gJfTuO-6b2Y” css=”.vc_custom_1615866353860{border-radius: 2px !important;}”][vc_column_text css=”.vc_custom_1616085713206{padding-top: 20px !important;padding-bottom: 20px !important;}”]Our video this week is an interview with “Canada’s Farm Whisperer” Elaine Froese. Get in touch with Elaine by visiting these links: https://elainefroese.com/ https://elainefroese.com/virtual-kitchen-table/ Background Image by Anna Workman, Life in Bloom Photography. [/vc_column_text][/vc_column][/vc_row]

Farmers and RRSPs

[vc_row][vc_column][vc_video link=”https://youtu.be/3jWpwJTQZZI”][vc_column_text css=”.vc_custom_1615307723455{padding-top: 20px !important;padding-bottom: 20px !important;}”]In this week’s video, we go over how to properly use RRSPs as a farmer.[/vc_column_text][/vc_column][/vc_row]

A Capital Gains Exemption Quirk

[vc_row][vc_column][vc_video link=”https://youtu.be/CqypqnZB0FA”][vc_column_text css=”.vc_custom_1613672399507{padding-top: 20px !important;padding-bottom: 20px !important;}”]If you’re not a farmer, but you own farmland that qualifies for the capital gain exemption, make sure you don’t pass away before using the exemption![/vc_column_text][/vc_column][/vc_row]

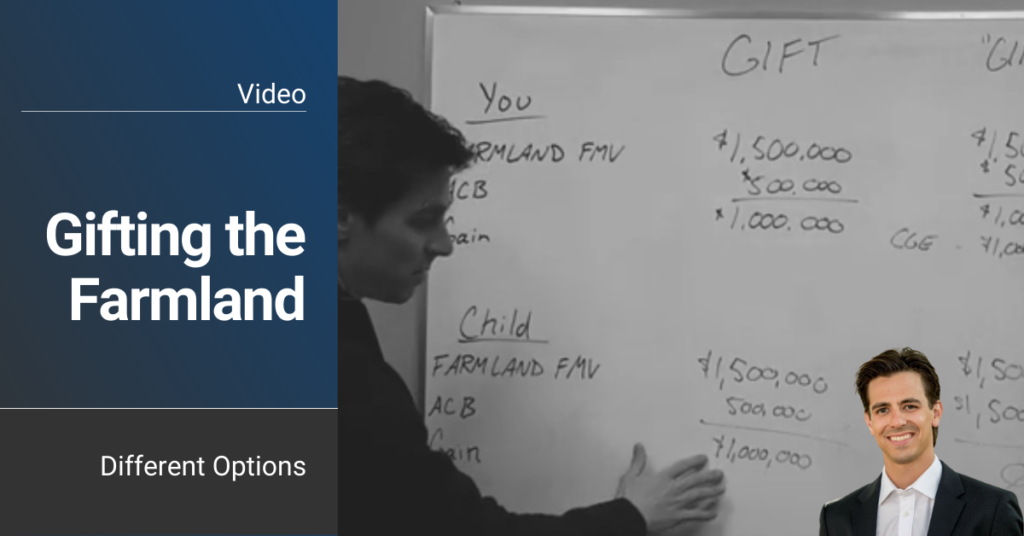

Gifting the Farmland

[vc_row][vc_column][vc_video link=”https://youtu.be/BY5NKn3F2Sc” css=”.vc_custom_1630350208840{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Gifting the Farmland In this week’s video we review the different ways you can gift farmland to your children along with the pros and cons of both methods.[/vc_column_text][/vc_column][/vc_row]

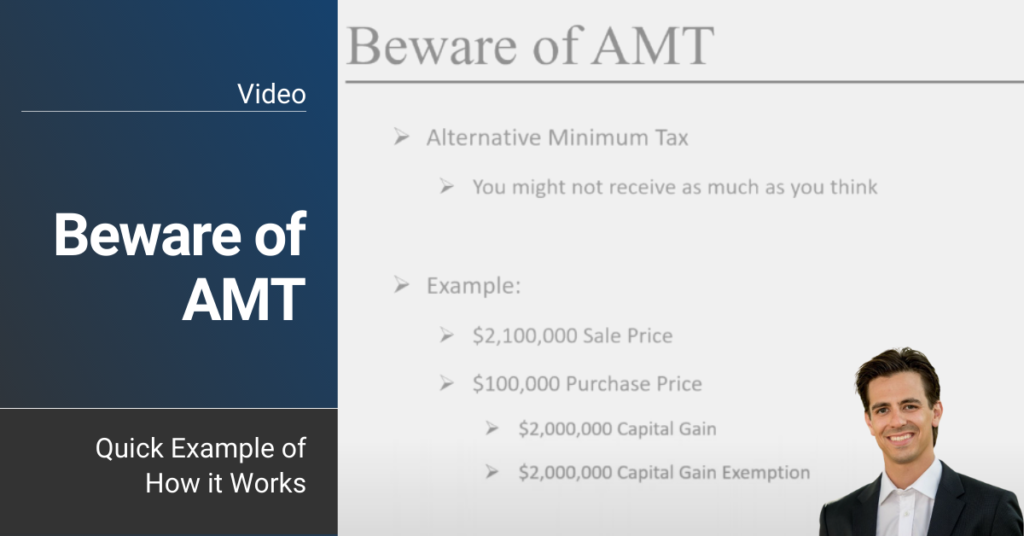

Beware of AMT

[vc_row][vc_column][vc_video link=”https://youtu.be/NOzkZQx7Fjw” css=”.vc_custom_1630350334573{padding-top: 20px !important;padding-bottom: 20px !important;border-radius: 10px !important;}”][vc_column_text css=”.vc_custom_1630350311731{padding-top: 20px !important;padding-bottom: 20px !important;}”] Beware of AMT Here is a quick video on what alternative minimum tax is and how it works. Enjoy![/vc_column_text][/vc_column][/vc_row]

Does Your Spouse Qualify?

[vc_row][vc_column][vc_video link=”https://youtu.be/hQK8bFO2JU8″ css=”.vc_custom_1630350476200{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Does your spouse qualify? This week we interviewed Julien Grenier, accountant, and partner at Talbot & Associates. We discuss what CRA looks at when determining whether your spouse can or can’t use their capital gains exemption on the sale of your farmland. Julien can be reached at julien.grenier@talbotcpa.ca or 204-269-7460[/vc_column_text][/vc_column][/vc_row]

Too Much Cash in Your Corp!

[vc_row][vc_column][vc_video link=”https://youtu.be/exR8blXVnOA” css=”.vc_custom_1630350554688{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Too much cash in your corp See my latest video going over a case study where one farmer thought his farm corporation qualified for the lifetime capital gains exemption but didn’t due to having too much cash.[/vc_column_text][/vc_column][/vc_row]

Let’s Multiply Your Capital Gains Exemption

[vc_row][vc_column][vc_video link=”https://youtu.be/VqzR8GWy8mY” css=”.vc_custom_1630352006724{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text] Let’s Multiply Your Capital Gains Exemption As a farmer, you have a lifetime exemption of one million dollar on the sale of farmland. If you exceed that amount, you could be looking at a large tax bill. Here is an option to increase your capital gains exemption. In this video, we will show two things. First, when no plan is in place and the ensuing tax bill. Second, […]

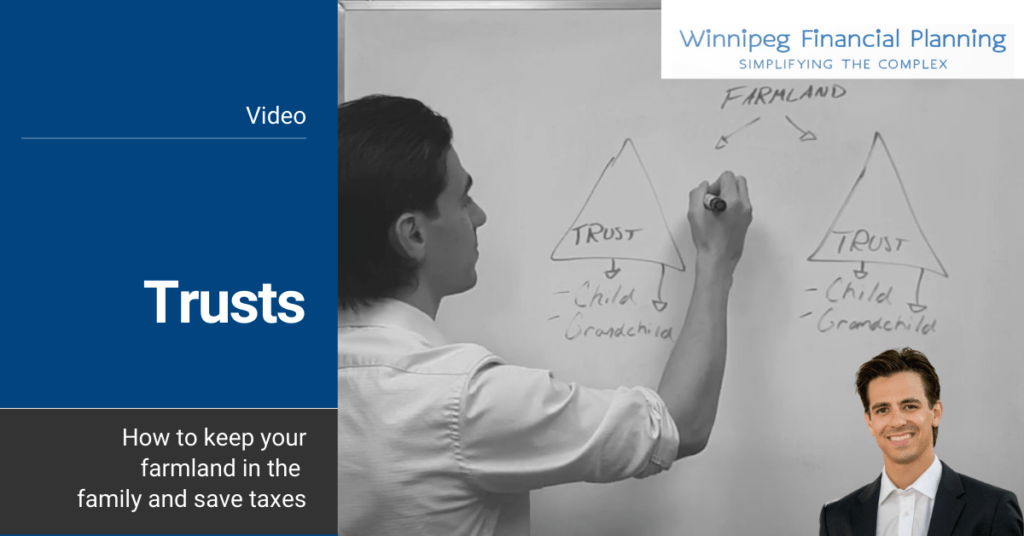

Trusts – How to keep your farmland in the family and save taxes

[vc_row][vc_column][vc_video link=”https://youtu.be/lbl7iwupODM” css=”.vc_custom_1630352063314{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]This quick video on trusts explains how to keep farmland within the family while being as tax-efficient as possible![/vc_column_text][/vc_column][/vc_row]

Private Health Care Spending Accounts: How Can They Help Your Business?

[vc_row][vc_column][vc_video link=”https://youtu.be/yU88uL6JvAQ” css=”.vc_custom_1630352425942{padding-top: 20px !important;padding-bottom: 20px !important;}”][vc_column_text]An Educational Webinar presented by Colin Sabourin CFP, CIM, CAFA, and Pierre Normandeau CPA, CGA, IMPORTANT: This webinar is for business owners who are incorporated. In the presentation, Colin and Pierre go step by step through: ➡️How Private Health Care Spending Accounts work ➡️What qualifies as a medical expense […]